The Magic Of Compound Interest: Let Your Money Grow Exponentially Over Time

Have you ever wondered how some people seem to make their money grow effortlessly while others struggle to make ends meet? It’s not a secret, it’s the magic of compound interest. With compound interest, your money can grow exponentially over time, helping you achieve your financial goals and secure a brighter future. In this article, we will explore the power of compound interest and how you can make it work for you. Get ready to be amazed, as we unveil the secrets behind this incredible financial phenomenon.

Understanding Compound Interest

What is compound interest?

Compound interest is a financial concept that allows your money to grow exponentially over time. It is the interest earned not only on the initial amount of money you invest or deposit but also on the interest that accumulates over time. In simple terms, it’s like earning interest on top of interest, which can significantly boost your savings or investment over the long term.

How does compound interest work?

When you invest or deposit money that accrues compound interest, the interest is usually calculated periodically, such as monthly or annually, and added to the principal amount. The subsequent interest calculations are based on the increased principal, which includes the interest that has already been earned. Over time, this compounding effect leads to exponential growth, allowing your money to grow much faster compared to simple interest.

The power of compounding

The power of compounding lies in the exponential growth it offers. As the interest is added to the principal amount, the subsequent interest calculations are based on the larger sum, resulting in a compounding effect. This compounding effect can significantly multiply your savings or investment over time, allowing you to accumulate wealth more rapidly compared to other forms of interest calculation.

Importance of starting early

One of the key factors that contribute to maximizing the benefits of compound interest is starting early. The earlier you start investing or saving, the more time your money has to compound. Even small amounts invested or saved in your early years can grow into substantial sums thanks to the power of compounding. Starting early not only allows you to take advantage of the extended time horizon but also reduces the pressure to contribute larger sums later in life.

Calculating Compound Interest

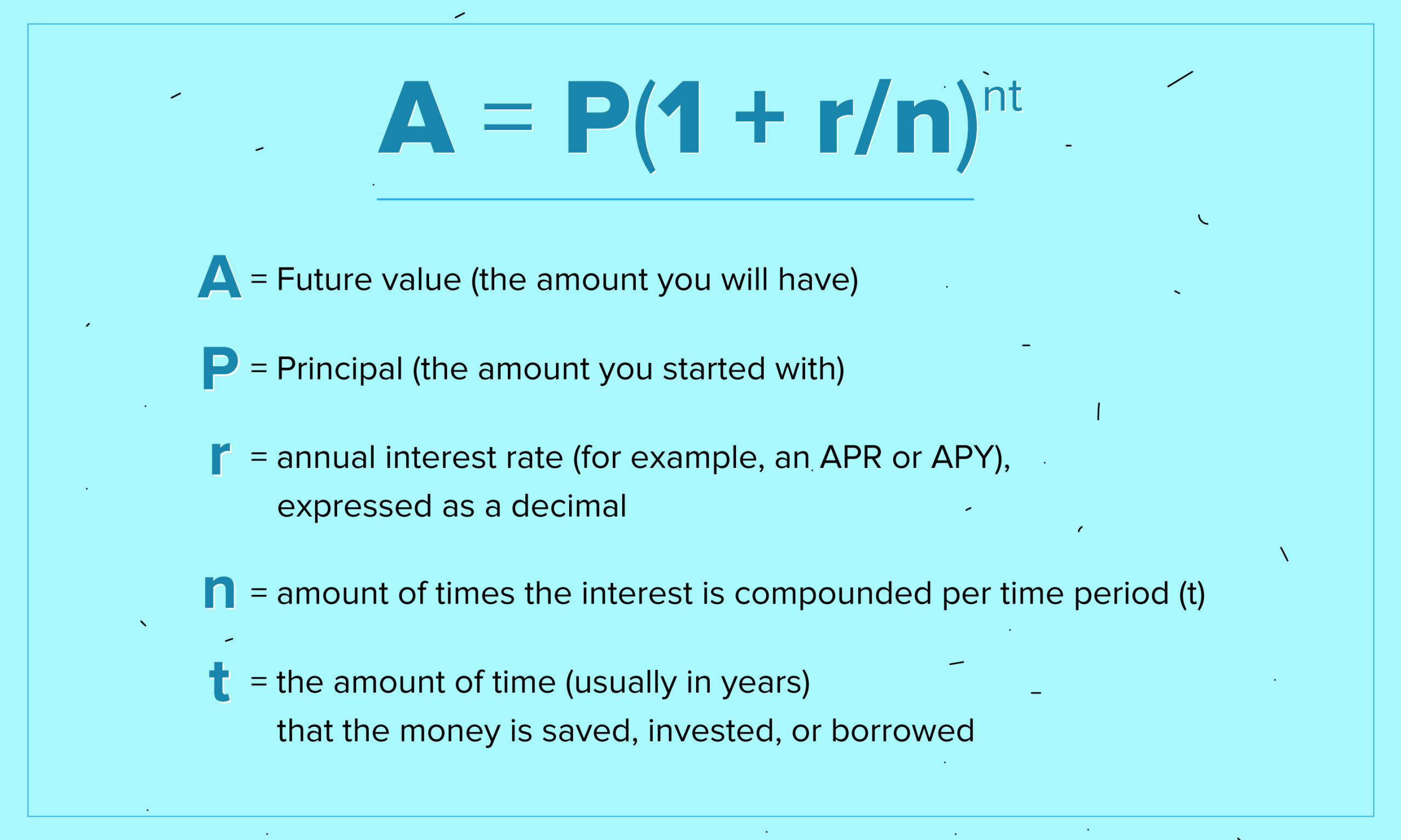

Formula for calculating compound interest

The formula for calculating compound interest is as follows:

A = P(1 + r/n)^(nt)

Where: A = the future value of the investment/loan, including interest P = the principal amount (initial investment or loan amount) r = the annual interest rate (as a decimal) n = the number of times that interest is compounded per year t = the number of years the money is invested or the loan is taken for

Understanding principal, interest rate, and time

To calculate compound interest, it is essential to understand the three key components: principal, interest rate, and time. The principal amount refers to the initial amount of money invested or the loan amount. The interest rate represents the annual percentage at which the investment or loan earns interest. Finally, the time component refers to the number of years the money will be invested or the loan will be taken for.

Using the compound interest formula in practice

Let’s say you want to calculate the future value of an investment. You have $5,000 to invest, and the annual interest rate is 5%. The interest is compounded annually, and you plan to invest the money for 10 years.

Using the compound interest formula:

A = $5,000(1 + 0.05/1)^(1*10) A = $5,000(1 + 0.05)^10 A = $5,000(1.05)^10 A = $5,000(1.628895) A ≈ $8,144.47

After 10 years, your investment would grow to approximately $8,144.47, thanks to compound interest.

Example calculations

To further illustrate the power of compound interest, let’s consider another example. Suppose you invest $10,000 with an annual interest rate of 7%. The interest is compounded quarterly, and you leave the money invested for 20 years. Using the compound interest formula, the future value of your investment would be approximately $38,698.34.

These examples demonstrate how compound interest can help your money grow significantly over time, enabling you to reach your financial goals faster.

Factors Affecting Compound Interest

Interest rate

The interest rate plays a crucial role in determining the growth of your investment or savings. A higher interest rate means your money will grow at a faster pace through compounding. When considering different investment options, it’s important to assess the interest rates offered and compare them to make informed decisions.

Compounding frequency

The compounding frequency refers to how often the interest is calculated and added to your investment or savings. The more frequently the interest is compounded, the faster your money will grow. Common compounding frequencies include annually, semi-annually, quarterly, or monthly. Choosing an investment or savings account with more frequent compounding can enhance the growth potential of your money.

Time

Time is a critical factor in the calculation of compound interest. The longer your money remains invested or saved, the greater opportunity it has to benefit from compounding. The compounding effect magnifies with each passing year, allowing your investment or savings to grow exponentially. Thus, starting early and giving your money ample time to compound is key to maximizing its growth potential.

Adding regular contributions

Regular contributions can also impact the growth of compound interest. By consistently adding to your investment or savings, you increase the principal amount. This not only allows for more substantial growth but also capitalizes on the compounding effect. Regular contributions can be made monthly, quarterly, or annually, and they help to accelerate the growth of your investment or savings.

Benefits of Compound Interest

Exponential growth of money

One of the significant benefits of compound interest is the exponential growth it offers. As time progresses, the earnings on your investment or savings gradually increase. The larger the principal amount, coupled with the compounding effect, leads to accelerated growth. Compound interest allows you to potentially accumulate wealth at a much faster rate compared to simple interest.

Building wealth over time

Compound interest can be a powerful tool in building long-term wealth. By consistently saving or investing and taking advantage of the compounding effect, you can gradually accumulate a significant sum of money over time. As the interest compounds, the growth of your wealth accelerates, allowing you to achieve your financial goals, such as homeownership, a comfortable retirement, or funding your children’s education.

Achieving financial goals

Compound interest can be a key factor in achieving your financial goals. Whether it’s saving for a down payment on a house, starting a business, or planning for retirement, the power of compound interest can help you reach these milestones faster. By starting early, contributing regularly, and harnessing the exponential growth that compound interest provides, you can achieve your financial goals with greater ease and confidence.

Creating a passive income stream

Compound interest can also create a passive income stream, allowing you to generate income without actively working for it. By saving or investing in assets that earn compound interest, such as dividend-paying stocks or interest-bearing bonds, you can build a portfolio that generates a steady stream of income over time. This passive income can provide financial stability and freedom, enabling you to pursue your passions or retire comfortably.

The Rule of 72

Understanding the Rule of 72

The Rule of 72 is a simple and effective method to estimate the time it takes for an investment or savings to double at a given interest rate. It is calculated by dividing 72 by the annual interest rate. The resulting number represents the approximate number of years it would take for your money to double.

Using the Rule of 72 to estimate compound interest

The Rule of 72 can help you gauge the potential growth of your investment or savings. For example, if you invested in a savings account with an interest rate of 6%, you can use the Rule of 72 to estimate that your money would double in approximately 12 years (72 divided by 6). This estimation can give you a rough idea of how long it may take to achieve your financial goals and help you make informed decisions about your investments.

Applying the Rule of 72 in financial planning

The Rule of 72 is a valuable tool in financial planning. It allows you to assess the impact of different interest rates on your investment or savings. By understanding how long it takes for your money to double, you can make strategic choices in terms of investment vehicles, compounding frequency, and time horizons. The Rule of 72 helps you evaluate the growth potential of different options and align them with your financial objectives.

Investment Options for Compound Interest

Savings accounts

Savings accounts are popular options for compound interest. They are low-risk and provide a safe place to grow your money over time. Many savings accounts offer competitive interest rates, and the interest is typically compounded on a regular basis, such as monthly or quarterly. It’s important to compare different savings accounts and their rates to find the best option for your financial goals.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are another investment option that offers compound interest. With CDs, you agree to deposit a certain amount of money for a fixed period, ranging from a few months to several years. In return, you earn a fixed interest rate that is generally higher than traditional savings accounts. The interest on CDs is typically compounded annually or at the end of the term.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations. They are a popular investment option for generating income and offer compound interest. The interest, known as coupon payments, is paid periodically, usually semi-annually or annually, and the principal is repaid at maturity. Bonds can provide a relatively stable investment with consistent interest payments, making them attractive to risk-averse investors.

Mutual funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer the potential for compound interest through the growth of the underlying investments. The interest earned by the fund is reinvested, contributing to the overall growth of your investment. Mutual funds provide a convenient way to diversify your portfolio and benefit from professional management.

Stocks

Stocks, or equities, represent ownership in a company. While stocks themselves do not offer compound interest, they can provide significant growth potential through capital appreciation and dividends. By investing in dividend-paying stocks, you can reinvest the dividends to harness the power of compound interest. Stocks are typically more volatile than other investment options and require careful research and analysis.

Real estate investments

Real estate investments can also generate compound interest through rental income and property appreciation. By investing in rental properties or real estate investment trusts (REITs), you can earn regular income and benefit from the potential growth in property values over time. Real estate can be an attractive long-term investment option, especially if you carefully select properties in high-demand areas.

Strategies to Maximize Compound Interest

Start investing early

Starting to invest or save as early as possible is an essential strategy to maximize compound interest. The longer your money has to compound, the greater the growth potential. Even modest contributions made in your early years can significantly multiply your initial investment or savings over time, thanks to the compounding effect. Starting early allows you to harness the power of time and enjoy exponential growth.

Consistent contributions

Consistency is key when it comes to maximizing compound interest. Regularly contributing to your investment or savings allows you to increase the principal amount and take advantage of the compounding effect. Whether it’s making monthly, quarterly, or annual contributions, maintaining a consistent savings or investment plan helps in achieving long-term financial goals.

Reinvesting dividends or interest

Reinvesting dividends or interest earned on your investment can further boost compound interest. Instead of taking the dividends or interest as cash, you can choose to reinvest them by purchasing additional shares or contributing them back into your savings. By reinvesting, you increase the principal that earns compound interest, accelerating the growth of your investment or savings.

Taking advantage of employer-matched contributions

If your employer offers a matching contribution program, taking full advantage of it can be a smart way to maximize compound interest. Employer-matched contributions essentially add free money to your investment or retirement savings. By contributing the maximum amount that your employer agrees to match, you instantly boost your principal and benefit from increased compound interest.

Diversifying investment portfolio

Diversifying your investment portfolio is important to manage risk and increase the potential for compound interest. By investing in a variety of asset classes, such as stocks, bonds, real estate, and mutual funds, you spread your risk and take advantage of different growth opportunities. Diversification allows you to capture the potential for compound interest across various investments, enhancing overall returns.

Risks and Considerations

Inflation

Inflation is an important factor to consider when dealing with compound interest. While your investment or savings may be growing through compounding, the purchasing power of that money may be eroded over time due to inflation. It is essential to account for inflation and ensure that the growth rate of your investment or savings exceeds the inflation rate to maintain the real value of your money.

Market volatility

Investments that offer compound interest, such as stocks and mutual funds, are subject to market fluctuations. Market volatility can impact the growth of your investment and may result in temporary declines in value. It’s important to understand the risks associated with different investments and be prepared for market fluctuations. A long-term perspective, diversification, and regular monitoring can help mitigate the impact of market volatility.

Understanding risk vs reward

Compound interest is a powerful tool, but it also comes with risks. Investments that offer higher compound interest rates often involve higher levels of risk. It’s important to understand the risk-reward tradeoff and assess your tolerance for risk. Conservative investors may opt for lower-risk investments with lower compound interest rates, while those comfortable with higher risk may pursue investments with potentially higher compound interest rates.

Seeking professional financial advice

When dealing with complex financial decisions, such as investing for compound interest, it’s wise to seek professional advice. Financial advisors can help assess your financial goals, risk tolerance, and investment options that align with your needs. They can provide guidance on asset allocation, diversification, and long-term financial planning, helping you make informed decisions to maximize compound interest.

Real-Life Examples

Case study: Compound interest and retirement savings

Let’s consider a case study to understand the impact of compound interest on retirement savings. Assume you start saving $200 per month at the age of 25 and continue until you retire at 65. By investing in a retirement account with an average annual return of 8%, your savings would grow to approximately $755,000. Without compound interest, your savings would only reach $148,000. This example highlights the significant role compound interest plays in long-term savings.

Examples of compound interest in different scenarios

Compound interest can be applied to various financial scenarios to demonstrate its potential. For instance, if you invest $1,000 with an annual interest rate of 6% compounded monthly for 5 years, your investment would grow to $1,348.63. Similarly, if you save $500 per month for 10 years in a savings account with an annual interest rate of 4%, your savings would total $73,069.43 at the end of the period. These examples showcase the power of compound interest in different situations.

Conclusion

The power of compound interest cannot be underestimated. It allows your money to grow exponentially over time, accelerating the achievement of your financial goals. Understanding how compound interest works, calculating it accurately, and leveraging the factors that affect it are essential for maximizing its benefits. By starting early, consistently contributing, diversifying your investments, and seeking professional advice, you can harness the magic of compound interest and pave the way towards long-term financial stability. So, take the first step today and let your money grow exponentially over time.