Passive Income Power: Build A Financial Safety Net With Dividend-Paying Stocks

Imagine having the ability to generate a steady stream of income without lifting a finger. With passive income from dividend-paying stocks, you can create a solid financial safety net for yourself. This article explores the power of passive income and how investing in dividend-paying stocks can help you build a stable and reliable source of additional funds. Discover the benefits of this investment strategy and learn how to make your money work for you, opening doors to financial freedom and peace of mind.

The Definition of Passive Income

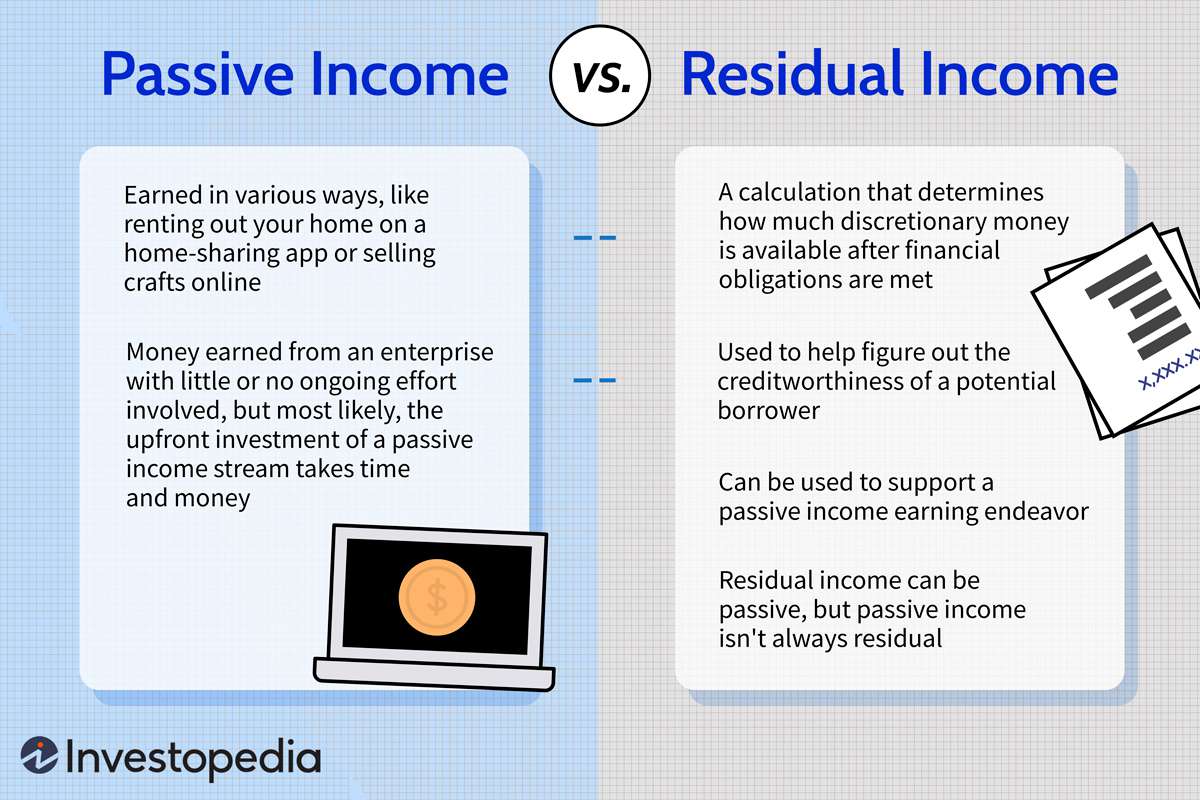

Understanding the concept of passive income

Passive income refers to the earnings that are generated with minimal effort or active involvement. It is income that flows continuously, allowing you to earn money while you sleep. Unlike active income, which requires direct participation in the form of work or services, passive income can be generated through various sources such as investments, real estate, or intellectual property. Understanding the concept of passive income is essential for those seeking financial freedom and the ability to create a long-term financial safety net.

Different types of passive income

Passive income can be derived from different sources, each with its own unique characteristics. Some common types of passive income include rental income from real estate properties, royalties from books or music, income from investments such as stocks or bonds, and income from businesses in which you have limited or no direct involvement. These different sources offer varying levels of risk, time commitment, and potential returns, allowing you to choose the passive income strategy that best aligns with your financial goals and preferences.

Introduction to Dividend-Paying Stocks

What are dividend-paying stocks?

Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders in the form of regular cash payments known as dividends. These stocks are usually issued by well-established and financially stable companies that generate consistent profits. By investing in dividend-paying stocks, you become a partial owner of the company and are entitled to share in its success through receiving a portion of its earnings.

How dividends are paid

Dividends are typically paid out on a quarterly basis, although some companies may choose to distribute them annually or semi-annually. The amount of dividend you receive is determined by the company’s board of directors, who consider factors such as the company’s profitability, cash flow, and future growth prospects. Dividends are usually paid in the form of cash, although some companies may offer the option to reinvest the dividends by purchasing additional shares of the company’s stock.

Benefits of investing in dividend-paying stocks

Investing in dividend-paying stocks can offer several benefits. Firstly, it provides a consistent stream of income, allowing you to supplement your regular earnings or build a passive income stream over time. Additionally, dividend-paying stocks have historically been less volatile compared to growth stocks, making them a suitable option for conservative investors seeking stability and lower risk. Finally, dividend payments can act as a hedge against inflation, as companies often increase dividend payments to keep up with rising prices. Overall, dividend-paying stocks can play a crucial role in your investment portfolio by providing a steady income stream and potential long-term growth.

Identifying the Best Dividend-Paying Stocks

Researching companies with a history of consistent dividends

When seeking to invest in dividend-paying stocks, it is crucial to research and identify companies with a history of consistently paying dividends. Look for companies that have a track record of increasing dividends over time, as this demonstrates their commitment to rewarding shareholders. A company’s financial stability, profitability, and cash flow should also be considered, as they are key factors in determining its ability to sustain dividend payments.

Examining the dividend yield

The dividend yield is a key metric to consider when evaluating dividend-paying stocks. It measures the annual dividend payment relative to the stock price. A higher dividend yield indicates a potentially higher return on investment, but it is essential to analyze the sustainability of the dividend payout. A very high dividend yield may indicate an undervalued stock or a company facing financial difficulties that could potentially lead to a suspension or reduction in dividend payments.

Analyzing the company’s financial health

Before investing in dividend-paying stocks, it is vital to assess the overall financial health of the company. Evaluate factors such as revenue growth, profitability, debt levels, and future growth prospects. A financially healthy company with a strong balance sheet and stable earnings is more likely to maintain and increase its dividend payments over time. Conduct thorough research and consult financial analysts or advisors for a comprehensive analysis of the company’s financial position.

Diversification and Portfolio Management

Diversifying your investments across different sectors

To mitigate risk and maximize potential returns, it is crucial to diversify your investments across different sectors. By investing in dividend-paying stocks from various industries, you can reduce the impact of sector-specific risks and create a more balanced portfolio. Diversification allows you to benefit from the growth and stability of different sectors, while minimizing the impact of any negative events that may affect a particular industry. A well-diversified portfolio can help protect your investments and ensure a more consistent dividend income stream.

Creating a dividend-focused portfolio

Building a dividend-focused portfolio involves selecting a mix of dividend-paying stocks that align with your investment goals and risk tolerance. Consider factors such as dividend yield, dividend growth rate, and overall financial health of the companies. Aim for a balanced mix of high-yield and growth-oriented dividend stocks to maximize potential returns while maintaining stability. Regularly review and rebalance your portfolio to adapt to changing market conditions and ensure that your investments continue to meet your objectives.

Balancing risk and reward

Investing in dividend-paying stocks involves a balancing act between risk and reward. While dividend-paying stocks typically offer lower volatility compared to growth stocks, they are not risk-free. Market fluctuations, economic downturns, and company-specific challenges can impact dividend payments and stock prices. It is essential to maintain a diversified portfolio, conduct thorough research, and monitor your investments regularly. By understanding and managing the risks associated with dividend investing, you can find a balance that aligns with your financial goals and risk tolerance.

The Power of Compounding

Understanding compounding and its effects on dividends

Compounding refers to the process of reinvesting earnings to generate additional returns over time. When it comes to dividends, reinvesting these cash payments back into the company through the purchase of additional shares can lead to significant growth in your investment. As you accumulate more shares, the increased number of shares entitle you to receive higher dividend payments in the future. This compounding effect can accelerate the growth of your dividend income and help you build wealth over the long term.

The advantage of reinvesting dividends

Reinvesting dividends offers several advantages. Firstly, it allows you to harness the power of compounding, enabling your investment to grow exponentially over time. Secondly, by reinvesting dividends, you can take advantage of dollar-cost averaging, which involves buying additional shares at different price points. This strategy helps to smooth out the impact of market volatility and can result in a lower average cost per share. Lastly, reinvesting dividends can boost the overall total return of your investment portfolio, leading to greater wealth accumulation.

Examples of compounding in action

To illustrate the power of compounding in dividend investing, let’s consider an example. Suppose you invest $10,000 in a dividend-paying stock that has an annual dividend yield of 4%. In the first year, you would receive $400 in dividends. If you choose to reinvest these dividends by purchasing more shares of the stock, your next year’s dividend payment would be based on the increased number of shares you hold. Assuming a consistent 4% dividend yield, your second-year dividend would be $416 (4% of $10,400), resulting in a $16 increase compared to the previous year. Over time, as the number of shares and dividend payments increase, the compounding effect can lead to significant growth in your investment and passive income stream.

Tax Considerations for Dividend Investors

Different tax rates for dividends

Dividend income is subject to different tax rates depending on your tax bracket and the type of dividends received. Qualified dividends are those that meet specific requirements set by the IRS and are generally taxed at the more favorable long-term capital gains tax rates. On the other hand, non-qualified dividends, which do not meet the qualifying criteria, are taxed as ordinary income at your regular tax rate. It is important to consult with a tax professional or advisor to understand your specific tax liabilities and plan accordingly.

Tax-efficient investment strategies

To minimize the tax impact on your dividend income, consider implementing tax-efficient investment strategies. One such strategy is investing in tax-advantaged accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, where dividend earnings can grow tax-free or tax-deferred until withdrawal. Additionally, holding dividend-paying stocks in a tax-efficient manner, such as investing in low turnover index funds or exchange-traded funds (ETFs), can help reduce taxable events and potential capital gains distributions.

Potential tax deductions for dividend investors

As a dividend investor, there may be opportunities to claim certain tax deductions. For example, if you incur expenses directly related to your investment activities, such as fees paid to financial advisors or subscription costs for investment research services, these expenses may be deductible. It is important to keep detailed records of your investment-related expenses and consult with a tax professional to determine what deductions you may be eligible for based on your specific circumstances.

Risks and Challenges of Dividend Investing

Market volatility and its impact on dividend payments

One of the risks associated with dividend investing is market volatility. During periods of economic uncertainty or market downturns, companies may face financial challenges and opt to reduce or suspend dividend payments. This can impact your passive income stream and the overall return on your investment. It is essential to diversify your portfolio, invest in financially stable companies, and stay informed about market conditions to mitigate the impact of market volatility on your dividend income.

Dividend cuts and fluctuations

Companies may occasionally reduce or cut their dividend payments due to various reasons, such as poor financial performance, changes in business strategy, or the need to allocate capital for other purposes. Dividend cuts can be a setback for dividend investors, as they can reduce the expected income and potentially impact the overall value of your investment. Conducting thorough research, monitoring company financials, and staying updated on market trends can help identify warning signs and mitigate the risk of dividend cuts.

Inflation and its effect on dividend income

Inflation erodes the purchasing power of money over time, and dividend income is not immune to its effects. While dividend-paying stocks can act as a hedge against inflation through potential increases in dividend payments, it is important to ensure that the dividend growth rate keeps pace with inflation. Investing in companies with a history of regularly increasing their dividends can help protect your income against the impact of rising prices. It is also crucial to diversify your investments and consider other inflation-protected assets, such as Treasury Inflation-Protected Securities (TIPS), to minimize the risk of erosion in purchasing power.

Building a Long-Term Financial Safety Net

Setting financial goals with dividend income

Dividend income can play a crucial role in building a long-term financial safety net. By setting specific financial goals, such as achieving a target level of passive income or saving for retirement, you can create a roadmap for your investment journey. Determine the amount of dividend income you need to cover your expenses or achieve your financial objectives and plan your investments accordingly. Regularly review and adjust your goals as needed to ensure that your dividends align with your evolving financial needs.

Reinvesting dividends for future growth

To enhance the growth potential of your dividend income, consider reinvesting the dividends back into your investment portfolio. By purchasing additional shares of dividend-paying stocks, you can accumulate more shares over time and potentially increase your future dividend payments. Reinvesting dividends can expedite the compounding effect and help you achieve your financial goals faster. However, it is important to strike a balance between reinvesting dividends and withdrawing a portion of the income to meet your short-term financial needs.

Creating a sustainable passive income stream

With careful planning and consistent investment in dividend-paying stocks, you can create a sustainable passive income stream that provides financial security and freedom. Focus on building a well-diversified portfolio of quality dividend stocks across different sectors and geographies. Maintain a long-term perspective and avoid making impulsive investment decisions based on short-term market movements. Regularly review the performance of your investments, rebalance when necessary, and stay informed about changes that may impact your dividend income. By adopting a disciplined approach and nurturing your dividend portfolio, you can cultivate a reliable and sustainable source of passive income.

Strategies for Maximizing Dividend Income

Investing in high-yield dividend stocks

One strategy for maximizing dividend income is to invest in high-yield dividend stocks. These are stocks that offer a higher dividend yield compared to the average yield of the market or their respective industry. However, it is important to conduct thorough research and assess the sustainability of the high dividend yield, as overly high yields may indicate financial instability or potential dividend cuts. Balancing the pursuit of high yields with the stability and growth potential of the underlying companies is critical for long-term success.

Timing dividend payouts and ex-dividend dates

Another strategy to consider is timing dividend payouts and ex-dividend dates. Dividend payouts are typically announced in advance, and you can strategically purchase stocks just before the ex-dividend date to become eligible for the upcoming dividend payment. This allows you to maximize the number of dividend payments you receive throughout the year. However, it is important to weigh the benefits of timing against the impact of short-term market movements and transaction costs.

Using dividend-focused ETFs or mutual funds

Investing in dividend-focused exchange-traded funds (ETFs) or mutual funds can offer a convenient and diversified approach to maximizing dividend income. These funds are designed to invest in a portfolio of dividend-paying stocks across various sectors, allowing you to benefit from the income generated by a broad range of companies. By investing in dividend-focused ETFs or mutual funds, you can gain exposure to a diversified portfolio with professional management, reducing the need for individual stock selection and portfolio management.

Conclusion

Recap of the benefits of dividend-paying stocks

Dividend-paying stocks offer an opportunity to build a long-term financial safety net by generating a consistent stream of passive income. By investing in dividend-paying stocks, you can benefit from regular cash payments and potentially participate in the growth of financially stable companies. Dividend income can be reinvested to accelerate the compounding effect, leading to significant wealth accumulation over time. Additionally, dividend-paying stocks can act as a hedge against inflation and provide stability in times of market volatility.

Taking action towards building a financial safety net

Building a financial safety net through dividend-paying stocks requires careful research, diversification, and a long-term investment perspective. Start by understanding the concept of passive income and identifying the different types of passive income that align with your financial goals. Explore the world of dividend-paying stocks, examining their characteristics, benefits, and risks. Conduct thorough research to identify the best dividend-paying stocks, focusing on companies with a history of consistent dividends and strong financial health.

Consider diversifying your investments across different sectors and creating a dividend-focused portfolio that balances risk and reward. Understand the power of compounding and the advantage of reinvesting dividends to accelerate the growth of your investment and passive income stream. Take into account tax considerations, seek tax-efficient investment strategies, and explore potential tax deductions. Be aware of the risks and challenges associated with dividend investing, such as market volatility, dividend cuts, and the impact of inflation.

Set specific financial goals with dividend income, regularly review and adjust your goals, and nurture a sustainable passive income stream. Consider strategies for maximizing dividend income, such as investing in high-yield dividend stocks, timing dividend payouts, and utilizing dividend-focused ETFs or mutual funds. By taking action and implementing these strategies, you can harness the power of dividend-paying stocks to build a solid financial safety net and achieve long-term financial security and freedom.