How To Pay Off Debt Faster: Proven Strategies

In “How To Pay Off Debt Faster: Proven Strategies,” you will discover effective and practical techniques to help you tackle your debt head-on and regain financial freedom. This article guides you through actionable steps such as creating a realistic budget, prioritizing your debts, and finding ways to boost your income. With these proven strategies, you can accelerate your journey to becoming debt-free, all while gaining confidence and peace of mind about your financial future.

How To Pay Off Debt Faster: Proven Strategies

Have you ever felt overwhelmed by debt and wondered if there’s a way to pay it off faster? Feeling burdened by financial obligations can be stressful, but the good news is there are proven strategies to help you manage and eliminate debt more quickly. This article will walk you through actionable steps to take control of your finances and reduce debt effectively.

Understanding Your Debt

Before diving into various strategies, it’s crucial to fully understand your debt situation. Knowing the different types of debt you owe, the interest rates, and the total amount can provide a clearer picture of your financial landscape.

List All Your Debts

Start by making a comprehensive list of all your debts. Include credit cards, personal loans, student loans, mortgages, and any other forms of debt.

| Debt Type | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card 1 | $5,000 | 18% | $100 |

| Student Loan | $15,000 | 4.5% | $150 |

| Auto Loan | $10,000 | 6% | $200 |

| Personal Loan | $7,000 | 8% | $130 |

This table can help you visualize your current debt situation and prioritize accordingly.

Calculate Your Total Debt

Add up all the balances to see your total debt. This number might seem alarming at first, but seeing it all laid out is the first step towards creating a plan to eliminate it.

Determine Your Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is a key metric lenders use to assess your ability to manage monthly payments. To calculate your DTI, divide your total monthly debt payments by your gross monthly income. Multiply the result by 100 to get a percentage.

For example, if your monthly debt payments are $1,000 and your gross monthly income is $4,000, your DTI is 25%.

Strategies to Pay Off Debt Faster

Once you have a firm understanding of your debt, it’s time to explore strategies that can help you pay it off faster. Below, we’ll discuss several proven methods.

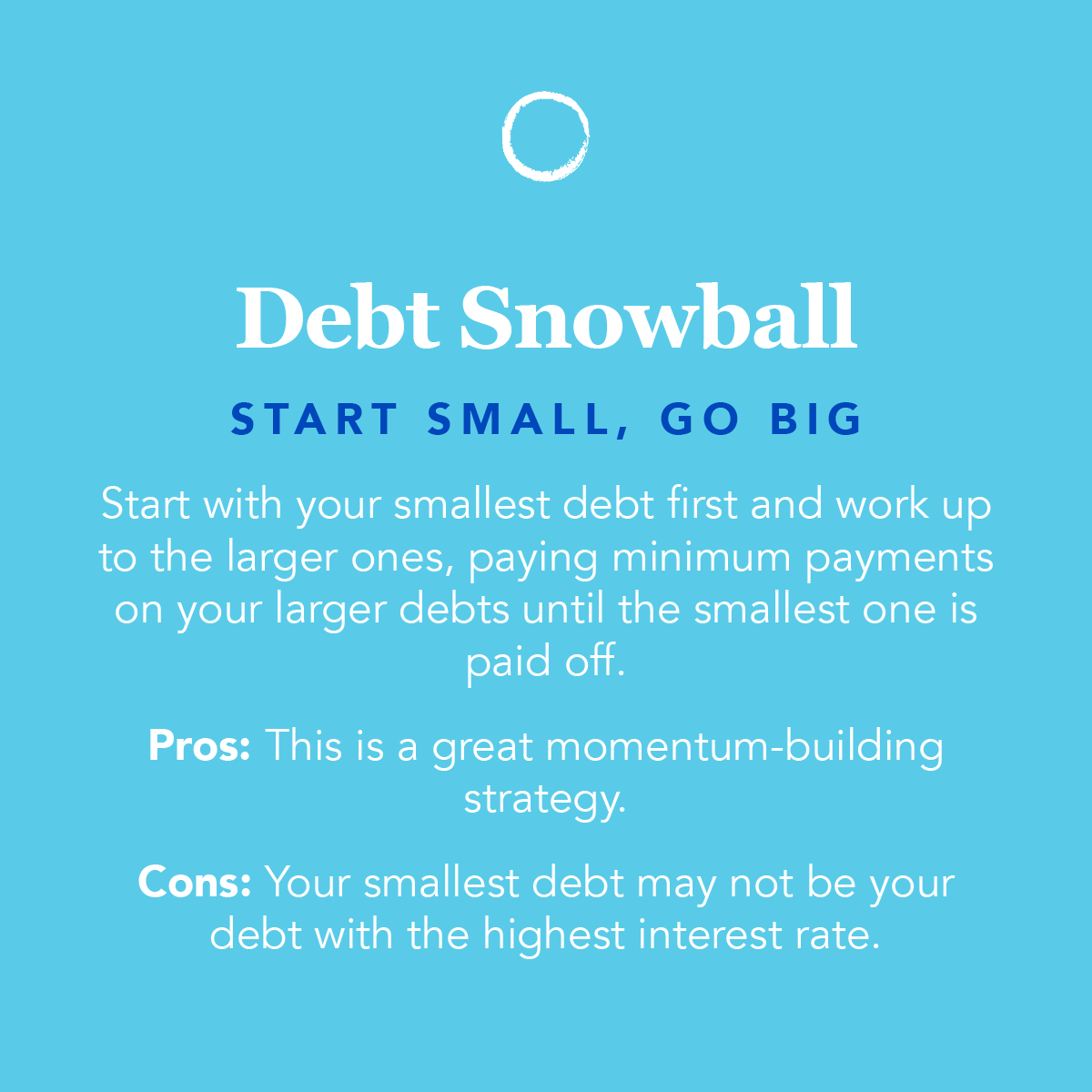

The Snowball Method

The Snowball Method involves paying off your smallest debt first while making minimum payments on all other debts. Once the smallest debt is paid off, you move on to the next smallest debt, creating a “snowball” effect.

- List your debts from smallest to largest.

- Focus on paying the smallest debt off first.

- Apply the payments you were making on the smallest debt to the next smallest once it’s paid off.

- Continue this process until all debts are paid.

This method is particularly effective because it provides quick wins that can keep you motivated.

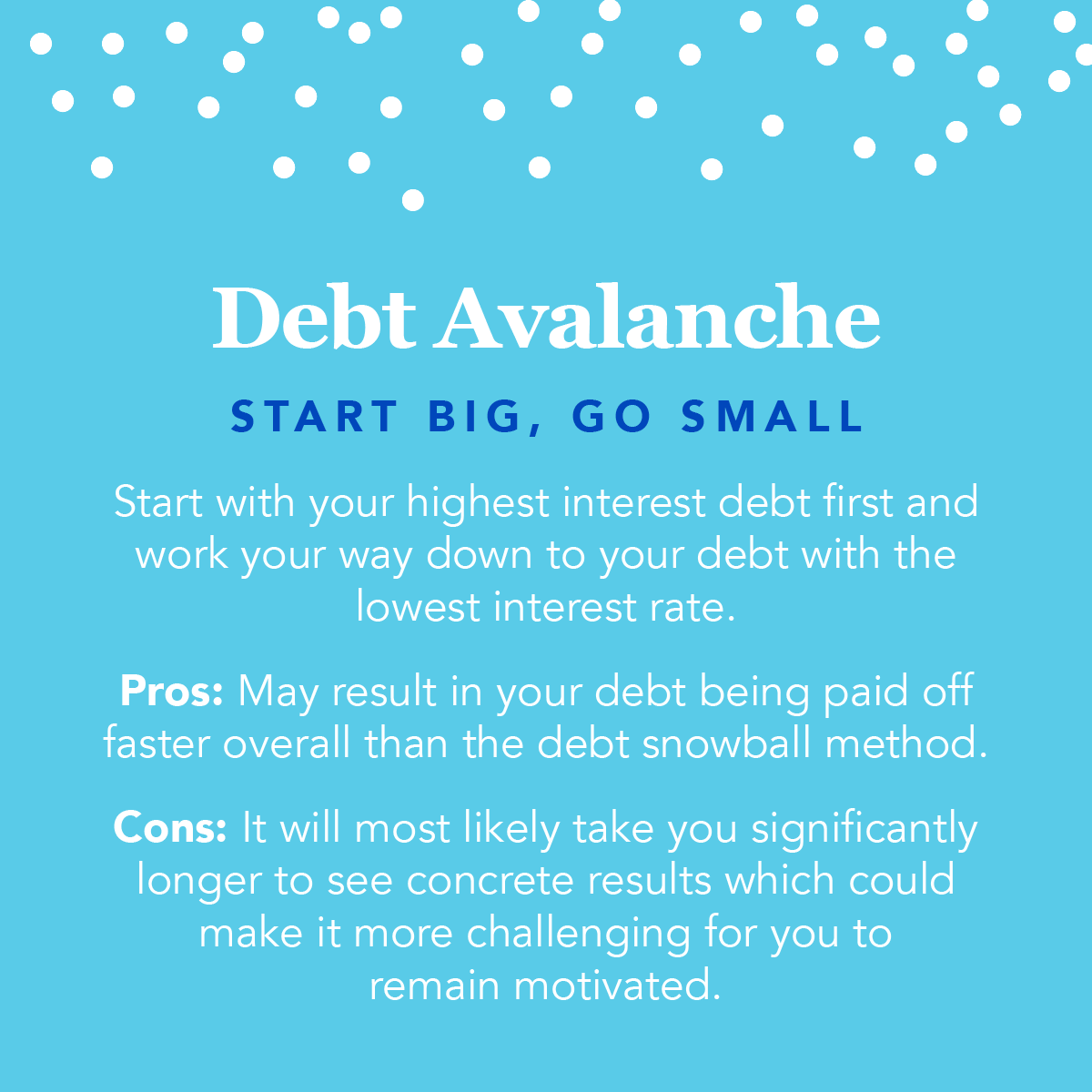

The Avalanche Method

Conversely, the Avalanche Method involves paying off debts with the highest interest rates first. This method can save you more money in the long run because it reduces the amount you’ll pay in interest over time.

- List your debts from highest to lowest interest rate.

- Focus on paying the highest interest debt off first.

- Apply the payments from the highest interest debt to the next highest once it’s paid off.

- Continue this process until all debts are paid.

Balance Transfer Credit Cards

If you have high-interest credit card debt, consider applying for a balance transfer credit card. These cards typically offer a low or 0% introductory interest rate for a certain period.

- Advantages: You can save on interest and pay off principal faster.

- Disadvantages: May require good credit to qualify, and balance transfer fees can apply.

Debt Consolidation Loan

A debt consolidation loan allows you to combine multiple debts into one loan with a single monthly payment. This can simplify your payments and potentially lower your interest rate.

- Advantages: Simplifies debt management and can reduce monthly payments.

- Disadvantages: You need a good credit score to qualify for the best rates.

Creating a Budget

Creating a budget is an essential part of any debt repayment plan. A budget helps you track your income and expenses so you can find additional money to put towards your debt.

Steps to Create a Budget:

- Calculate your total monthly income.

- List all fixed expenses (e.g., rent, utilities).

- List all variable expenses (e.g., groceries, entertainment).

- Compare your total expenses to your income.

- Adjust your spending to maximize the amount you can put towards debt.

Example Budget:

| Income | Monthly Amount |

|---|---|

| Salary | $4,000 |

| Freelance Income | $1,000 |

| Total Income | $5,000 |

| Expense | Monthly Amount | Category |

|---|---|---|

| Rent | $1,200 | Fixed |

| Utilities | $150 | Fixed |

| Groceries | $400 | Variable |

| Dining Out | $150 | Variable |

| Entertainment | $100 | Variable |

| Debt Payments | $1,000 | Fixed |

| Savings | $300 | Fixed |

| Miscellaneous | $300 | Variable |

| Total Expenses | $3,600 |

Remaining Income for Debt Payment: $1,400

Increasing Your Income

Finding ways to increase your income can accelerate your debt repayment. Here are some practical ideas to boost your income:

Side Hustles

Consider part-time work, freelance gigs, or online jobs. Popular side hustles include:

- Ridesharing (e.g., Uber, Lyft)

- Freelance writing or graphic design

- Tutoring or teaching online courses

Selling Unwanted Items

If you have items you no longer need or use, selling them can generate extra cash. Consider using platforms like eBay, Facebook Marketplace, or Craigslist.

Asking for a Raise

If you’ve been with your employer for a while and have been performing well, consider negotiating a raise. Be prepared with information on your contributions and industry salary standards.

Reducing Your Expenses

Cutting down on unnecessary expenses can free up additional money to put towards your debt.

Cut Cable or Streaming Services

Do you really need multiple streaming subscriptions or a high-cost cable package? Consider cutting back or downgrading to save money.

Dining Out Less

Cooking at home more often can save you a significant amount each month. Plan your meals and bring lunch to work to reduce dining-out expenses.

Shop Smart

Look for sales, use coupons, and buy in bulk when possible. Also, consider generic brands; they’re often just as good as name brands but cost less.

Lower Utility Bills

Take steps to reduce your utility bills, such as using energy-efficient appliances, sealing drafts, and being mindful of water and electricity usage.

Avoiding New Debt

One key to paying off debt faster is to avoid taking on new debt while you’re working on repayment.

Use Cash or Debit

To avoid adding to your credit card debt, use cash or a debit card for purchases. This can help you stay within budget and avoid high interest charges.

Emergency Fund

Establish an emergency fund to cover unexpected expenses. Even a small cushion can prevent you from turning to credit cards in a crisis. Aim for at least $1,000 initially and build it up to three to six months’ worth of living expenses.

Avoid Temptation

Be mindful of situations that may tempt you to spend. Unsubscribe from marketing emails, avoid window shopping, and delay purchases to consider if you really need them.

Automate Your Payments

Setting up automatic payments can ensure you never miss a payment, avoiding late fees and keeping your debt repayment on track.

Benefits of Automation

- Consistency: Regular payments help you stay on schedule.

- Avoid Late Fees: Automatic payments prevent missed payments and associated fees.

- Improved Credit Score: Consistent, on-time payments can boost your credit score over time.

How to Set Up Automatic Payments

Most creditors offer online account management where you can set up recurring payments. You can also use your bank’s online bill pay service.

Tracking Your Progress

Regularly reviewing your progress can keep you motivated and help you adjust your plan as needed.

Use a Debt Payoff App

Numerous apps can help you track your progress and stay motivated. Popular options include:

- Mint: Offers budgeting tools and tracks debt.

- You Need a Budget (YNAB): Focuses on budgeting and debt repayment.

- Debt Payoff Planner: Specifically designed for tracking debt payoff.

Regular Check-Ins

Set a schedule to review your finances, such as weekly or monthly. Check your budget, track your spending, and assess your progress towards paying off your debt.

Maintaining a Positive Mindset

Staying motivated is key to tackling debt. Here are ways to maintain a positive mindset throughout your journey.

Set Milestones

Break your debt repayment plan into smaller, achievable milestones. Celebrate each milestone to keep your spirits high.

Reward Yourself

Allow yourself small rewards for meeting goals. This doesn’t mean splurging, but simple rewards like a nice dinner at home or a day off can keep you motivated.

Focus on the Long-Term Benefits

Remind yourself of the benefits of becoming debt-free: financial freedom, reduced stress, and the ability to save and invest more effectively.

Seeking Professional Help

Sometimes, professional advice can be invaluable in managing debt. Consider consulting a financial advisor or credit counseling service.

Financial Advisors

A financial advisor can help you create a personalized debt repayment plan and provide guidance on budgeting, saving, and investing.

Credit Counseling Services

Nonprofit credit counseling agencies can help you negotiate with creditors, consolidate debt, and provide financial education. Be sure to choose a reputable organization, such as those approved by the National Foundation for Credit Counseling (NFCC).

Conclusion

Paying off debt faster is a realistic goal if you’re equipped with the right strategies. By understanding your debt, creating a plan, and staying disciplined, you can achieve financial freedom. Remember, it’s not just about paying off debt but also about building healthy financial habits that will benefit you long-term. Stay positive, stay focused, and take it one step at a time. You’ve got this!