The Benefits Of Paying Off Your Mortgage Early

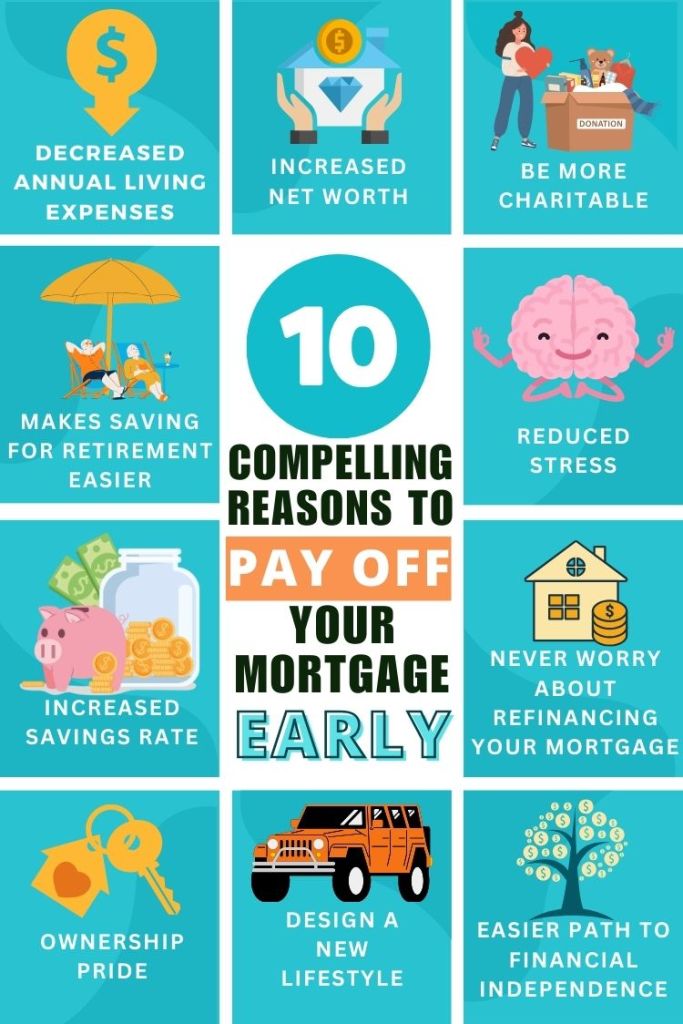

In “The Benefits Of Paying Off Your Mortgage Early,” you’ll discover how freeing yourself from the burden of a long-term mortgage can offer you a range of advantages. From enjoying significant financial savings and improved peace of mind to opening up new opportunities for investment and increased financial flexibility, this article walks you through the key reasons why paying off your mortgage ahead of schedule can be one of the best financial moves you’ll ever make.

Have you ever wondered what it would feel like to live completely mortgage-free? Imagine the peace of mind and financial freedom that can come with owning your home outright. Paying off your mortgage early is an ambition many homeowners strive for, and it’s not just about the emotional relief. There are numerous tangible benefits, both immediate and long-term, that make this goal worth pursuing. In this article, we’ll delve into the many advantages of paying off your mortgage early, outlining why and how you might consider making this rewarding financial move.

Financial Freedom

Choosing Your Lifestyle

When you’ve paid off your mortgage, you can truly choose the lifestyle you want without the weight of monthly mortgage payments. Whether that means retiring early, traveling more, or simply enjoying more leisure time, financial freedom gives you the flexibility to live life on your own terms.

Improved Cash Flow

Without a mortgage payment each month, your cash flow significantly improves. You can repurpose those funds towards other financial goals such as saving for retirement, building an emergency fund, or investing in other ventures.

Emergency Readiness

Financial emergencies are stressful, but having your mortgage paid off allows you to respond to unexpected situations with less financial strain. Your home remains a stable asset, offering a buffer and potentially serving as collateral if needed.

Financial Savings

Interest Savings

One of the most compelling reasons to pay off your mortgage early is the potential savings on interest. Mortgages, especially long-term ones, can accrue a significant amount of interest over their lifespan. By paying off your loan ahead of schedule, you save thousands of dollars.

| Mortgage Term | Original Interest Cost | Paid Off Early Interest Cost | Savings |

|---|---|---|---|

| 30-year | $120,000 | $60,000 | $60,000 |

| 15-year | $60,000 | $30,000 | $30,000 |

This table shows hypothetical savings by paying off a mortgage early.

No More PMI

Private Mortgage Insurance (PMI) can add a substantial cost to your monthly payments if you put down less than 20% when you bought your home. Paying off your mortgage eliminates the need for PMI, potentially saving you hundreds of dollars annually.

Reducing Financial Risk

Paying off your mortgage can be a highly effective method to decrease your overall financial risk. With a paid-off home, you’re less vulnerable to economic fluctuations that may impact your ability to meet your mortgage obligations.

Psychological Benefits

Peace of Mind

Financial stress is a common concern, but paying off your mortgage can offer significant relief. Knowing that your home is completely paid for brings an immense amount of peace of mind and security.

Improved Mental Well-Being

Research shows that financial stress can impact your mental health adversely. By eliminating your mortgage payments, your overall mental well-being can improve as you free yourself from the constant worry about making payments.

Sense of Accomplishment

Paying off a mortgage is a significant achievement. It symbolizes financial responsibility and diligent planning. This sense of accomplishment can boost your self-esteem and motivate you to achieve other financial goals.

Investment Opportunities

More Disposable Income

With no mortgage payment, you have more disposable income each month. This extra cash can be invested in various opportunities such as stocks, mutual funds, or even starting your own business.

Diversifying Investments

By paying off your mortgage, you can diversify your investment portfolio. This is a more balanced approach to long-term wealth building, rather than having all your assets tied up in your home.

Real Estate Opportunities

Paying off your mortgage allows you to consider other real estate investments. Whether it’s a rental property or a vacation home, freed-up funds can make these opportunities more attainable.

Retirement Preparedness

Boost Retirement Savings

Without the mortgage payment, you can contribute more to your retirement accounts such as a 401(k), IRA, or other retirement savings plans. Enhancing your retirement savings will ensure you have a more comfortable and secure retirement.

Lower Monthly Expenses

Lower monthly expenses in retirement can greatly impact your financial stability. With a mortgage out of the equation, you can manage your retirement income more effectively, allowing you to enjoy your retirement years without financial stress.

Secure Legacy

A paid-off home can be part of the legacy you leave to your heirs. It can serve as a valuable asset that your family can inherit, either providing a safe place for them to live or an investment that continues to grow in value.

Planning to Pay Off Your Mortgage

Evaluate Your Financial Situation

Before making the decision to pay off your mortgage early, it’s crucial to evaluate your current financial situation carefully. Look at your savings, retirement funds, and other financial obligations to ensure you are in a strong position to allocate extra funds toward your mortgage.

Pay More Than the Minimum

A common strategy to pay off your mortgage early is to pay more than the minimum required payment. Even adding small amounts to your monthly payment can significantly shorten the lifespan of the loan.

Utilize Windfalls

If you receive windfalls like bonuses, tax refunds, or inheritances, consider putting all or part of these funds toward your mortgage. These lump-sum payments can make a big difference in reducing your principal balance.

Refinance Smartly

Refinancing to a shorter-term loan can also help you pay off your mortgage faster while potentially lowering your interest rate. Just be sure to weigh the costs of refinancing against the potential savings.

Bi-weekly Payments

Another effective method is to switch to bi-weekly payments instead of monthly. By making a payment every two weeks, you end up making one extra payment per year, which can significantly reduce the length of your mortgage.

:max_bytes(150000):strip_icc()/sick-of-mortgage-payments-pay-off-your-home-early-453826_Final-201fc508b83c4f839d73a7a8bb4d1098.png)

Potential Drawbacks to Consider

Opportunity Cost

One potential drawback of paying off your mortgage early is the opportunity cost. The money used to pay down your mortgage could be invested elsewhere potentially earning a higher return.

Loss of Tax Deductions

Mortgage interest payments can be tax-deductible, thereby reducing your taxable income. By paying off your mortgage, you lose out on these deductions, which may affect your overall tax strategy.

Liquidity Concerns

Once you’ve paid off your mortgage, the money used is not easily accessible. Unlike other investments, the equity in your home is not liquid and can’t be readily converted into cash should you need it.

Prepayment Penalties

Some mortgages come with prepayment penalties. It’s important to check if your mortgage has such clauses and calculate whether these penalties offset the benefits of paying off your mortgage early.

Conclusion

Paying off your mortgage early can provide a multitude of advantages ranging from improved financial security and mental well-being to enhanced investment opportunities and retirement preparedness. While it does come with some potential drawbacks, the benefits often far outweigh the negatives for many homeowners. Careful planning, smart financial strategies, and a strong commitment are key to achieving this goal.

Would you consider paying off your mortgage early? Picture the financial freedom and peace of mind it could bring to your life. With thoughtful planning and dedication, this rewarding milestone can become a reality. So why not take the first step today toward a mortgage-free future?