How To Save For Retirement In Your 20s And 30s

Saving for retirement might seem like a distant goal when you’re navigating your 20s and 30s, but trust me, it’s never too early to start planning for your future. In “How To Save For Retirement In Your 20s And 30s,” you’ll discover practical tips and strategies that make it easier to build a solid nest egg while you’re still young. From understanding the importance of compound interest to making the most of employer-sponsored retirement plans and personal savings, this guide will walk you through the essential steps to secure financial stability in your golden years. It’s all about taking small, smart actions now to ensure a comfortable and stress-free retirement later.

How To Save For Retirement In Your 20s And 30s

Have you ever wondered how you might be able to enjoy a comfortable retirement if you start saving early? Many people see retirement as a distant dream, reserved for the future. But, the truth is, the sooner you start, the smoother the journey will be. Your 20s and 30s are the perfect decades to kickstart your retirement savings.

Saving for retirement in your early adult years might seem daunting, especially when you have student loans, a budding career, and social commitments. However, the power of compound interest means that even small contributions made now can grow significantly over time. Ready to dive in? Let’s break down how you can start planning for that golden retirement.

Why Save for Retirement Early?

Saving for retirement early sets the foundation for financial freedom. By starting in your 20s and 30s, you avoid playing catch-up later. It’s not just about the amount you save but also the time your savings have to grow. Compound interest can exponentially increase your savings, providing an easier path to financial security.

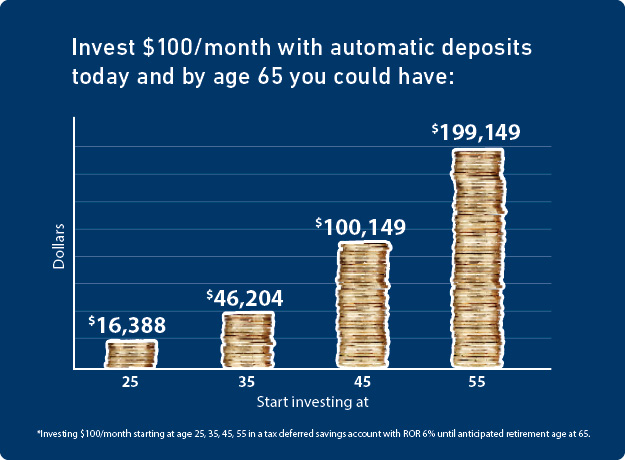

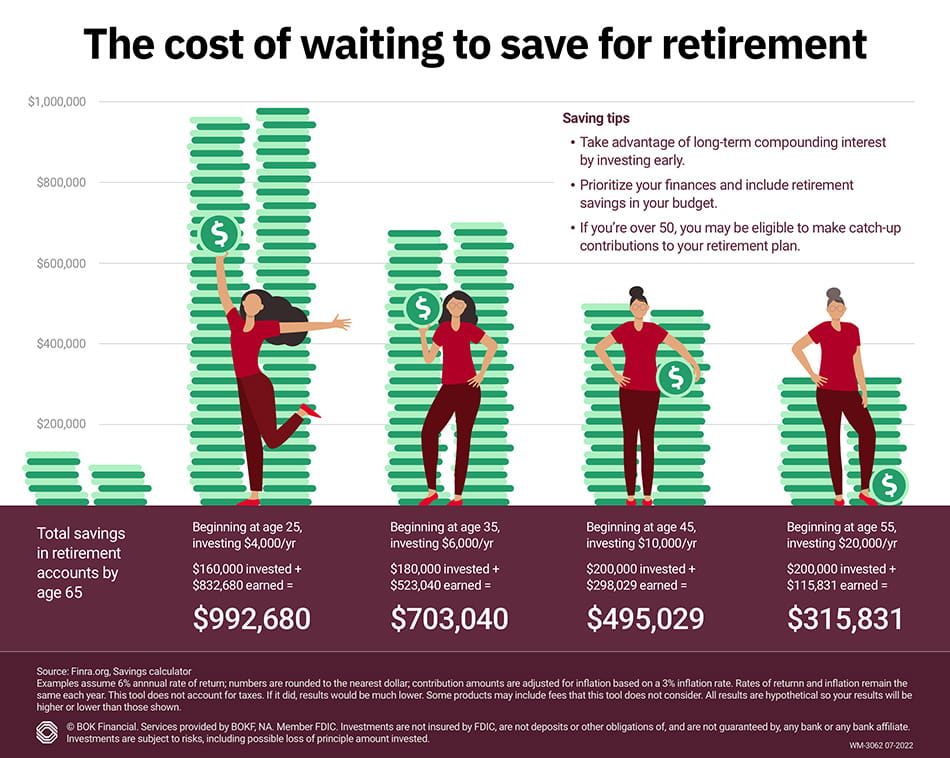

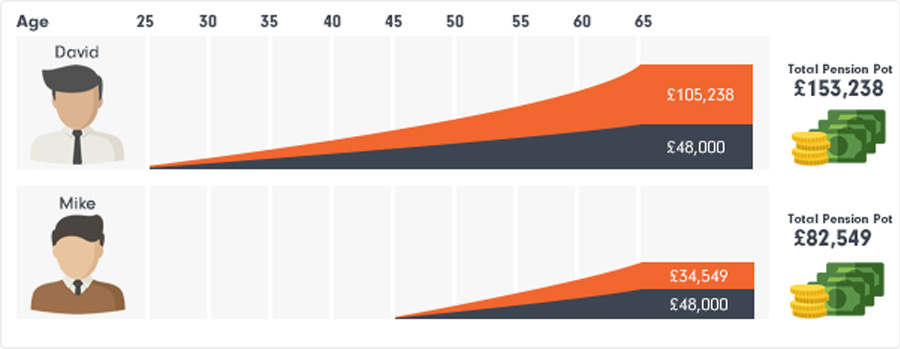

The Magic of Compound Interest

One of the most powerful tools at your disposal when you start early is compound interest. This is essentially earning “interest on your interest,” allowing your money to grow exponentially over time.

For example, if you save $200 a month starting at age 25 and earn an average return of 7% annually, you’d have approximately $540,000 by the time you turn 65. But if you start saving $200 a month at age 35, you’d accumulate about $244,000 by age 65.

| Starting Age | Monthly Contribution | Annual Return | Total Savings by Age 65 |

|---|---|---|---|

| 25 | $200 | 7% | $540,000 |

| 35 | $200 | 7% | $244,000 |

Clearly, starting sooner has a significant impact.

Time Is on Your Side

In your 20s and 30s, you have a longer time horizon until retirement. This means your investments can withstand the ups and downs of market cycles and still grow substantially over time. You’re in a prime position to take calculated risks that could lead to higher returns.

Setting Goals

Before diving into specific strategies, it’s crucial to set clear, attainable retirement goals. What kind of lifestyle do you want in retirement? Do you want to travel, start a business, or simply relax? Your answers will guide how aggressively you need to save and invest.

Determine Your Retirement Needs

To estimate how much you’ll need, consider potential expenses like housing, healthcare, and leisure activities. An often-cited rule of thumb is to aim to replace 70-80% of your pre-retirement income. However, personal circumstances can vary, so a more customized calculation might be necessary.

Use Retirement Planning Tools

There are various online calculators that can help you project your retirement savings needs. Tools like the Vanguard Retirement Nest Egg Calculator or the Fidelity Retirement Score can provide insights based on your current savings, expected retirement age, and desired annual retirement income.

Building a Robust Savings Plan

Now that you understand the importance of early saving and have a goal in mind, it’s time to build a robust savings plan. This involves choosing the right accounts, automating your savings, and making smart investment choices.

Employer-Sponsored Plans

If your employer offers a retirement plan like a 401(k), it’s a good place to start. Many employers offer matching contributions up to a certain percentage. This is essentially free money, so make sure to take full advantage of it.

Understanding Matching Contributions

Let’s say your employer matches 50% of your contributions up to 6% of your salary. If you earn $50,000 a year and contribute 6% ($3,000), your employer will add an additional $1,500.

Opening an Individual Retirement Account (IRA)

If your employer doesn’t offer a retirement plan, or if you’re looking for additional ways to save, consider opening an IRA. There are two main types: the Traditional IRA and the Roth IRA.

| IRA Type | Contributions | Tax Benefits | Withdrawal Rules |

|---|---|---|---|

| Traditional IRA | Tax-deductible | Tax-deferred growth | Taxed at withdrawal |

| Roth IRA | After-tax dollars | Tax-free growth | Tax-free withdrawal |

Setting Up Automatic Contributions

Automating your contributions ensures consistency. Many financial institutions allow you to set up automatic transfers from your checking account to your retirement accounts. This “pay yourself first” strategy makes saving a priority.

Smart Investment Choices

Choosing where to invest your money is just as important as deciding how much to save. A diversified investment portfolio can help manage risks while maximizing returns.

The 80/20 Rule

In your 20s and early 30s, it’s generally recommended to have a more aggressive investment strategy. The 80/20 rule (80% stocks, 20% bonds) is a common guideline. Stocks offer higher growth potential, while bonds provide stability.

Index Funds and ETFs

Consider investing in low-cost index funds and ETFs. These funds mimic the performance of a specific index and normally have lower fees compared to actively managed funds. Over time, lower fees can mean substantial savings.

Rebalancing Your Portfolio

Regularly review and rebalance your portfolio to maintain your desired asset allocation. This involves selling some assets and buying others to keep your investment mix aligned with your risk tolerance and goals.

Managing Debt While Saving

Balancing debt repayment with retirement saving can be challenging. However, it’s crucial to strike a healthy balance between the two.

High-Interest Debt

Focus on paying off high-interest debt first, such as credit card balances. The interest rates on these debts likely exceed the returns you’d make on investments, so paying them off can be a form of guaranteed investment.

Student Loans

If you have student loans, consider refinancing to get a lower interest rate or exploring income-driven repayment plans. This can free up more money for retirement savings.

Lifestyle Choices and Savings

Your lifestyle choices can significantly impact your ability to save for retirement. Being mindful of your spending habits and making conscious decisions can help you stay on track.

Budgeting

Create a detailed budget that includes your income, expenses, debt payments, and savings goals. This not only helps you stay organized but also highlights areas where you can cut back and save more.

Living Within Your Means

Avoid lifestyle inflation as your income increases. It’s tempting to spend more when you earn more, but maintaining a modest lifestyle can accelerate your savings and investment growth.

Side Hustles and Additional Income Streams

Consider generating extra income through side hustles or passive income streams. Whether it’s freelancing, renting out a room, or investing in real estate, additional income can bolster your retirement savings.

Emergency Fund

Before aggressively saving for retirement, it’s wise to build an emergency fund. This fund acts as a financial cushion for unforeseen expenses, ensuring you don’t dip into your retirement savings prematurely.

How Much Should You Save?

A common rule of thumb is to have 3-6 months’ worth of living expenses in an easily accessible account. This ensures that you can cover emergencies without derailing your long-term financial goals.

Where to Keep Your Emergency Fund

Keep your emergency fund in a high-yield savings account or a money market account. These accounts provide easy access to your money while earning some interest.

Health Savings Account (HSA)

An HSA is not only a tax-advantaged way to save for medical expenses, but it can also be a valuable part of your retirement plan.

Triple Tax Advantage

HSAs offer a triple tax advantage: contributions are tax-deductible, investments grow tax-deferred, and withdrawals are tax-free for qualified medical expenses. After age 65, non-medical withdrawals are taxed similarly to a Traditional IRA.

Contribution Limits

For 2023, the contribution limits are $3,850 for individuals and $7,750 for families. If you’re 55 or older, you can contribute an additional $1,000.

Continuing Education

Stay informed about personal finance and retirement planning. The financial landscape is constantly changing, and continuous learning will help you make informed decisions.

Books and Podcasts

Read books like “The Simple Path to Wealth” by JL Collins or “Your Money or Your Life” by Joe Dominguez and Vicki Robin. Additionally, podcasts like “The Dave Ramsey Show” or “ChooseFI” offer valuable insights and practical tips.

Seeking Professional Advice

Consulting with a financial advisor can provide personalized guidance tailored to your unique situation. They can help you create a comprehensive retirement plan and offer strategies to optimize your savings and investments.

Types of Financial Advisors

- Fee-Only Advisors: Charge a flat fee or a percentage of assets under management. They don’t earn commissions, minimizing potential conflicts of interest.

- Commission-Based Advisors: Earn commissions on the products they sell. Be cautious and ensure their recommendations align with your best interests.

Staying Motivated

Saving for retirement is a long-term commitment, and staying motivated is key. Celebrate your milestones, review your progress regularly, and remind yourself of the benefits of financial security in retirement.

Set Milestones

Break down your retirement savings goal into smaller, achievable milestones. This makes the process less overwhelming and allows you to track your progress.

Review and Adjust

Review your retirement plan annually or after significant life changes (e.g., marriage, having kids, job changes). Adjust your contributions and investments as needed to stay on track with your goals.

Conclusion

Saving for retirement in your 20s and 30s is one of the most impactful financial decisions you can make. With the power of compound interest, time on your side, and a strategic approach, you can build a strong foundation for a comfortable retirement. Remember to set clear goals, choose the right savings and investment vehicles, balance your debt, and stay informed. By starting early, you’re giving yourself the best chance at financial independence and a worry-free retirement. Happy saving!