52-Week Savings Challenge: Turbocharge Your Emergency Fund In A Year

Imagine having a robust emergency fund that gives you peace of mind in times of unexpected financial hurdles. With the 52-Week Savings Challenge, you can turbocharge your emergency fund in just one year. By making small, incremental contributions each week, you will be amazed by how quickly your savings grow. Say goodbye to financial stress and hello to financial security as you embark on this simple yet effective savings journey.

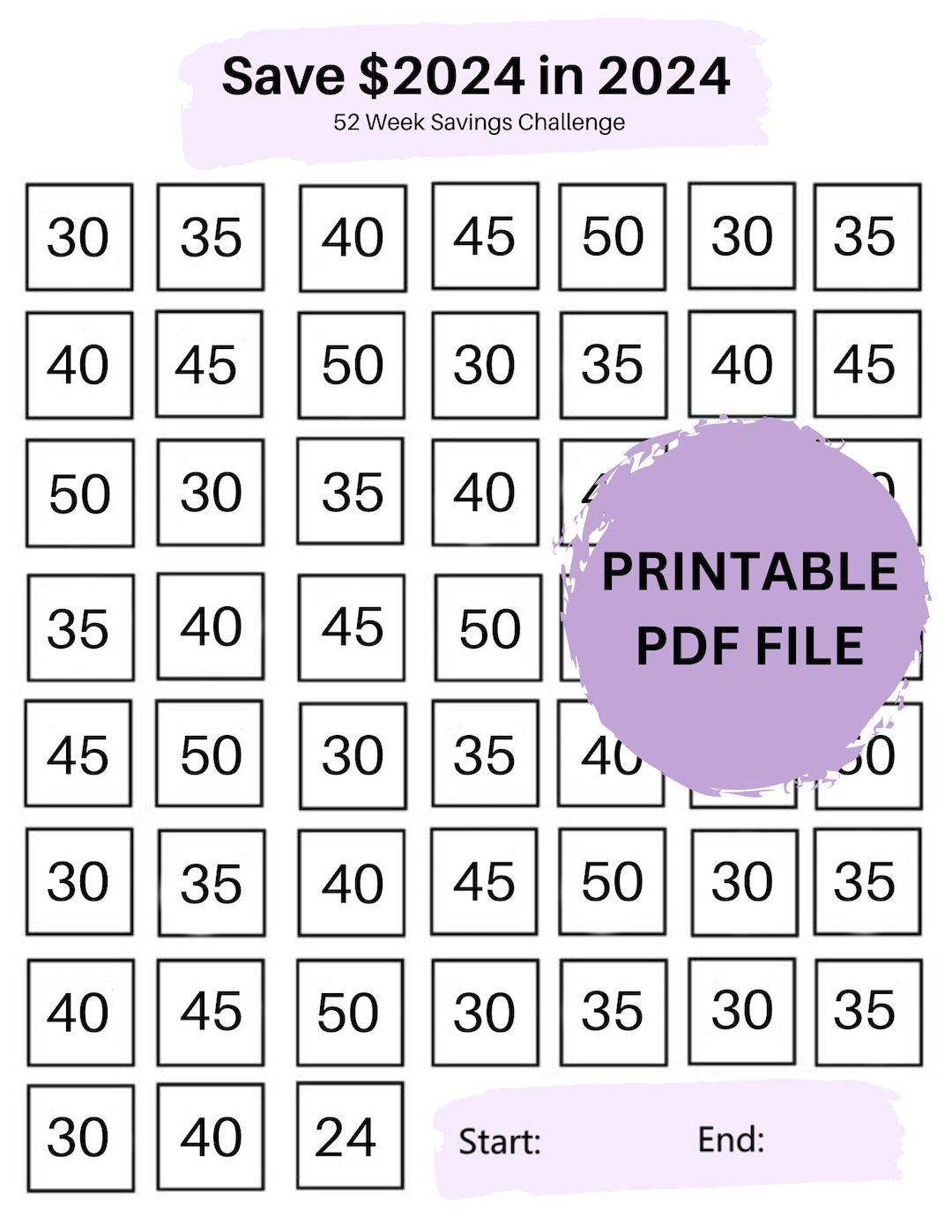

This image is property of i.etsystatic.com.

What is the 52-Week Savings Challenge?

Definition

The 52-Week Savings Challenge is a popular savings method that helps you build an emergency fund over the course of a year. It involves saving a specific amount of money each week, starting with just $1 and gradually increasing the contribution week by week. By the end of the 52 weeks, you will have accumulated a substantial amount of money to use for unexpected expenses or to achieve your financial goals.

Benefits

The 52-Week Savings Challenge offers several benefits that can positively impact your financial well-being. Firstly, it cultivates a habit of regular savings, which is essential for long-term financial security. Additionally, it helps you develop discipline and financial responsibility by committing to save a specific amount each week. Finally, it allows you to build an emergency fund, providing you with peace of mind and the ability to handle unexpected expenses without financial stress.

Getting Started

Setting Your Goal

Before you start the 52-Week Savings Challenge, it’s important to define your saving goal. Determine how much you want to save by the end of the year and what you plan to use the money for. Whether you aim to create an emergency fund, save up for a vacation, or pay off outstanding debts, having a clear goal will keep you motivated throughout the challenge.

Creating a Budget

To successfully complete the 52-Week Savings Challenge, you need to create a realistic budget. Calculate your monthly income and expenses to identify areas where you can cut back and allocate more towards savings. This may involve trimming unnecessary expenses, negotiating bills, or finding cheaper alternatives. Remember, every dollar saved counts and brings you closer to achieving your goal.

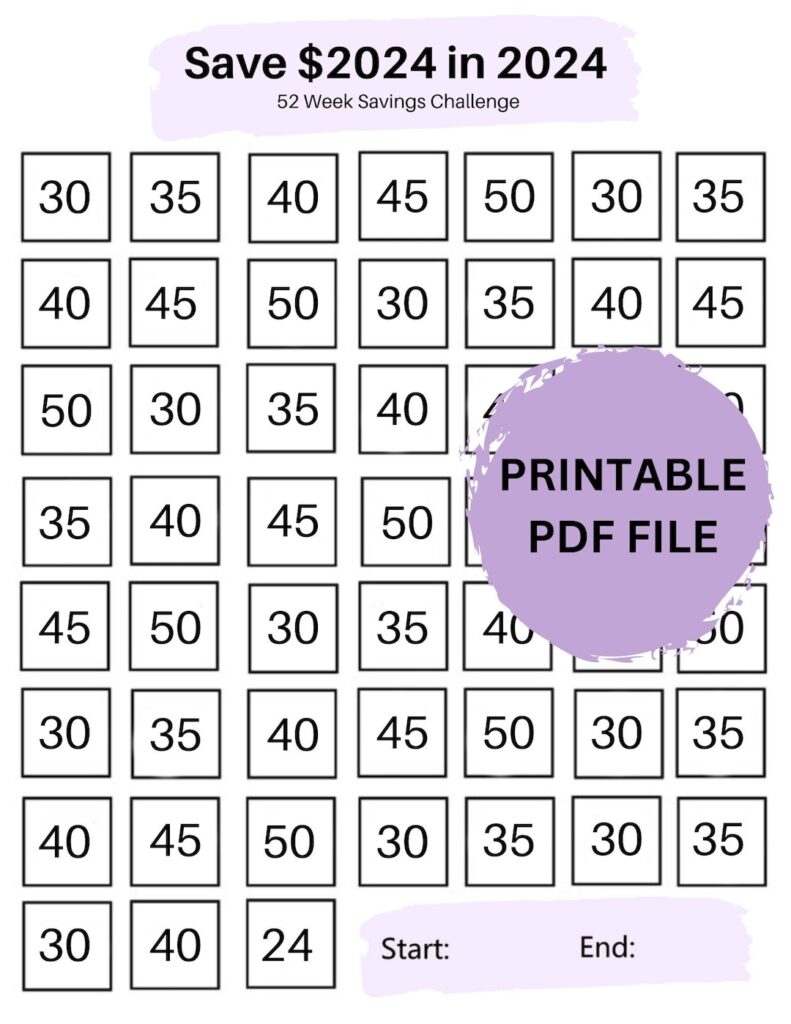

This image is property of i.etsystatic.com.

Choosing the Right Method

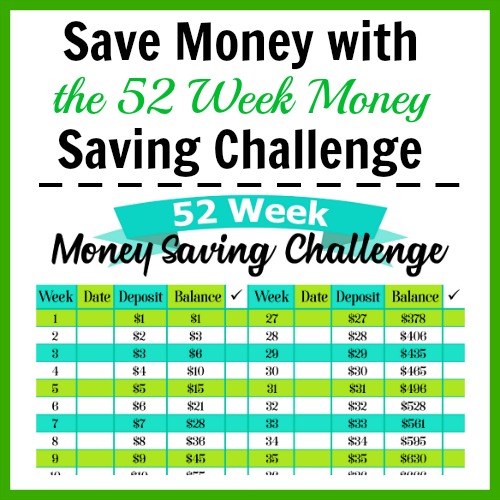

The Traditional Method

The traditional method of the 52-Week Savings Challenge involves starting with a small amount and gradually increasing it each week. For example, you save $1 in week one, $2 in week two, $3 in week three, and so on. This method is suitable for individuals who have a steady income and prefer a predictable saving schedule.

The Reverse Method

The reverse method flips the traditional approach, allowing you to save more at the beginning of the year and gradually reduce the amount each week. For instance, you save $52 in week one, $51 in week two, $50 in week three, and so forth. This method may be beneficial for those who have more disposable income at the start of the year and want to tackle larger savings goals early on.

The Customized Method

If the traditional or reverse method doesn’t align with your financial situation, you can create a customized 52-Week Savings Challenge. With this method, you have the flexibility to decide how much you want to save each week. You can choose a constant amount, a variable amount based on your income, or even mix the traditional and reverse methods. Customizing the challenge allows you to adapt it to your unique circumstances and increases the likelihood of success.

Tips for Success

Automate Your Savings

To make the 52-Week Savings Challenge easier, automate your savings. Set up a recurring transfer from your checking account to a separate savings account each week. This way, you won’t have to rely on remembering to transfer the money manually, and it becomes a consistent part of your financial routine.

Cut Back on Expenses

Reducing your expenses is crucial for successful savings. Look for ways to cut back on discretionary items such as eating out, entertainment, and subscriptions. Consider packing lunch for work, using coupons, or purchasing generic brands. Small changes in your spending habits can add up to significant savings over time and accelerate your progress in the challenge.

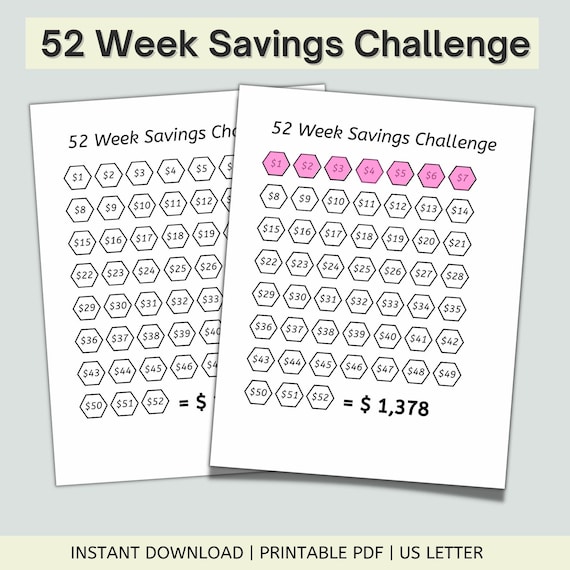

Track Your Progress

Tracking your progress is essential to stay motivated and on track. Create a visual representation (e.g., a savings chart or spreadsheet) that shows how much you’ve saved each week. Being able to see your progress can be incredibly motivating and give you a sense of accomplishment as you check off each week. Celebrate milestones along the way to keep the momentum going.

This image is property of i.etsystatic.com.

Week-by-Week Savings Plan

Now, let’s dive into the week-by-week savings plan of the 52-Week Savings Challenge. Each week, you will save a specific amount, starting with just $1 and increasing incrementally. Here’s a breakdown of how the plan progresses:

Week 1: $1

Week 2: $2

Week 3: $3

Week 4: $4

Week 5: $5

Week 6: $6

…

Week 52: $52

By following this plan, you will successfully save a total of $1,378 by the end of the 52 weeks.

Savings Boosters

Coupons and Discounts

Coupons and discounts can significantly boost your savings. Take advantage of digital coupons, loyalty programs, and promotional offers to reduce the cost of your purchases. Before making any buying decisions, check for available coupons and compare prices to ensure you get the best possible deal.

Sell Unwanted Items

Do you have items lying around your home that you no longer need or use? Selling these unwanted items can be a great way to generate extra cash for your savings. Consider online platforms, such as eBay or Facebook Marketplace, or organize a garage sale to convert your clutter into savings.

Take on a Side Gig

If you have spare time and want to accelerate your savings, consider taking on a side gig. This can be freelancing, online tutoring, pet sitting, or any other activity that allows you to earn extra income. The additional earnings can be allocated directly towards your savings, helping you reach your goal faster.

This image is property of i.etsystatic.com.

Staying Motivated

Reward Yourself

As you progress through the 52-Week Savings Challenge, remember to reward yourself along the way. Set mini-rewards for specific milestones or achievements to keep yourself motivated. The rewards can be as simple as treating yourself to a small indulgence or taking a day off to relax. Celebrating your progress will make the journey more enjoyable and reinforce positive savings habits.

Find an Accountability Partner

Having someone to hold you accountable can greatly increase your chances of success in any challenge. Find a friend, family member, or colleague who is also interested in saving money and undertake the 52-Week Savings Challenge together. You can motivate and support each other, share savings tips, and celebrate milestones together.

Visualize Your Goals

Create a vision board or a visual representation of what your savings goal represents. Whether it’s a picture of your dream vacation destination, a debt-free balance statement, or a symbol of financial freedom, seeing your goal daily will keep you focused and determined. Visualization can be a powerful tool in turning your aspirations into reality.

Dealing with Unexpected Expenses

Emergency Fund vs. Emergency Expenses

It’s important to differentiate between an emergency fund and emergency expenses. An emergency fund is a pool of money set aside for unexpected events, while emergency expenses are unforeseen costs that can deplete your savings. It’s essential to have a fully funded emergency fund before using it to cover unexpected expenses. This way, you can ensure you have enough financial security and prevent setbacks in your savings journey.

Rebuilding After Using Your Fund

If you have to tap into your emergency fund due to unforeseen expenses, it’s crucial to rebuild it as soon as possible. Adjust your budget to allocate more towards savings to replenish the fund. Consider cutting back on non-essential expenses or finding additional sources of income to accelerate the rebuilding process. Building the habit of consistently contributing to your emergency fund even after using it will help you maintain financial stability in the long run.

This image is property of acultivatednest.com.

The Benefits of a Fully Funded Emergency Fund

Peace of Mind

Having a fully funded emergency fund brings peace of mind. Knowing that you have the financial resources to handle unexpected expenses reduces stress and anxiety. You can navigate through challenging times without worrying about how to cover the costs, giving you greater peace of mind and emotional well-being.

Financial Security

A fully funded emergency fund provides financial security. With this safety net in place, you can handle unexpected situations such as medical emergencies, car repairs, or job loss without resorting to high-interest loans or credit card debt. Having financial security allows you to focus on long-term financial goals and plan for the future with confidence.

Ability to Seize Opportunities

Beyond the peace of mind and financial security, a fully funded emergency fund grants you the ability to seize opportunities. Whether it’s investing in a promising business venture, taking advantage of a once-in-a-lifetime opportunity, or pursuing a passion project, having the financial means readily available empowers you to make bold moves and pursue your dreams.

Conclusion

As you reflect on your success and the completion of the 52-Week Savings Challenge, remember the impact it has made on your financial well-being. You have cultivated a habit of regular savings, developed discipline and financial responsibility, and built a fully funded emergency fund. Continuously nurture this savings habit by setting new goals and finding innovative ways to maximize your savings. The 52-Week Savings Challenge is just the beginning of your financial journey towards long-term security and prosperity.