How To Create A Financial Plan For Single Parents

Navigating the financial landscape as a single parent can be challenging, but with the right strategies, it becomes an achievable and empowering journey. In “How To Create A Financial Plan For Single Parents,” you’ll discover practical steps to help you manage your money, secure your family’s future, and achieve financial independence. This guide covers everything from budgeting and saving to understanding investment options and seeking financial assistance. Start crafting a solid financial plan that aligns with your unique needs and goals, and take control of your financial destiny with confidence.

Have you found yourself juggling the demands of parenting solo while trying to keep a strong financial footing? Being a single parent is a rewarding yet challenging journey, and managing your finances can sometimes feel like an uphill battle. But don’t worry! With a bit of planning and some practical strategies, you can build a solid financial plan to set you and your kids up for a bright future.

Understanding Your Financial Situation

Before you can create a financial plan, it’s essential to get a clear picture of where you stand financially. This means assessing your income, expenses, debts, and assets to understand what’s coming in, what’s going out, and what you owe.

Assessing Your Income

The first step in creating a financial plan is knowing exactly how much money you have available each month. Your income includes your wages, alimony, child support, government benefits, and any other sources of money you regularly receive.

Monthly Income Table:

| Source | Amount | Frequency |

|---|---|---|

| Salary/Wages | $ | Monthly |

| Child Support | $ | Monthly |

| Alimony | $ | Monthly |

| Government Benefits | $ | Monthly |

| Side Business/Freelance | $ | Monthly |

| Other | $ | Monthly |

Evaluating Your Expenses

Next, you’ll need to track your spending. It can be eye-opening to see where your money goes each month. Categorize your expenses as follows to get a detailed view.

Monthly Expenses Table:

| Category | Amount | Notes |

|---|---|---|

| Rent/Mortgage | $ | |

| Utilities | $ | |

| Groceries | $ | |

| Transportation | $ | Including gas |

| Childcare/Education | $ | |

| Insurance | $ | Health, car, etc. |

| Entertainment/Leisure | $ | |

| Debt Payments | $ | Loans, credit cards |

| Savings/Investments | $ | Retirement, etc. |

| Miscellaneous | $ | Other expenses |

Identifying Debts and Assets

Take stock of any debts you owe and assets you have. This can include credit card balances, student loans, car loans, retirement accounts, and property.

Debts and Assets Table:

| Financial Element | Amount | Notes |

|---|---|---|

| Credit Card Debt | $ | |

| Student Loan Debt | $ | |

| Auto Loan | $ | |

| Mortgage | $ | |

| Retirement Accounts | $ | |

| Other Assets | $ | Property, etc. |

Setting Financial Goals

Creating a solid financial plan involves setting clear, actionable goals. Goals give you direction and a sense of purpose, and they can keep you motivated and focused on your financial journey.

Short-Term Goals

Short-term goals are aims you can achieve within the next year. These goals could include things like saving for a family vacation, paying off a small debt, or building an emergency fund.

Medium-Term Goals

Medium-term goals are set for one to five years. For example, you might aim to pay down your car loan, save for your child’s education, or undertake a home improvement project.

Long-Term Goals

Long-term goals span over five years or more. These could involve saving for retirement, buying a home, or ensuring your child’s college education fund is healthy.

Prioritizing Your Goals

It’s crucial to prioritize these goals based on urgency and importance. Focus on creating an emergency fund and reducing high-interest debt before moving on to other goals.

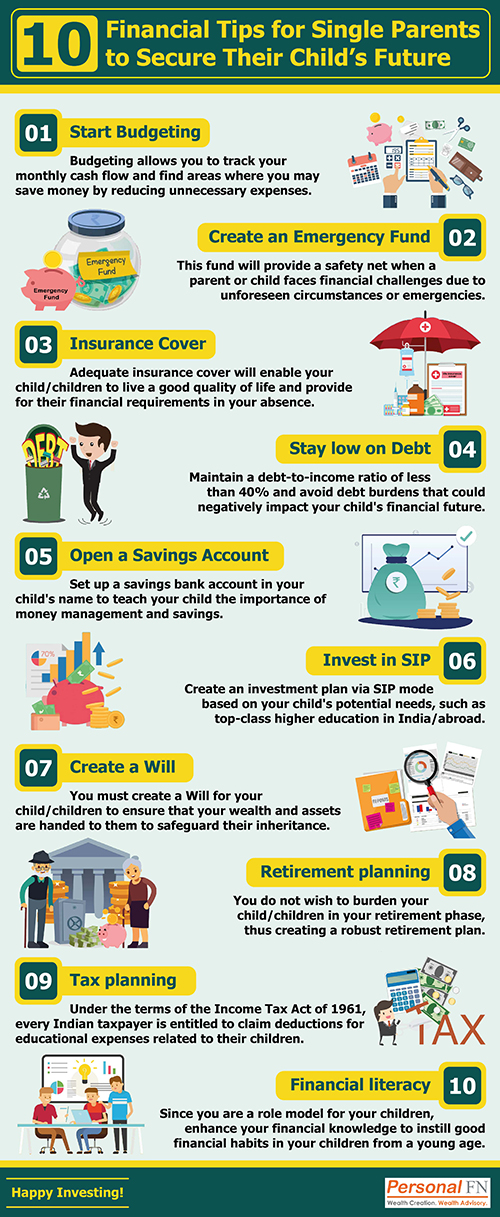

Creating a Budget

A budget is your financial blueprint. It helps you allocate your income toward necessary expenses, savings goals, and discretionary spending.

The 50/30/20 Rule

A good starting point is the 50/30/20 rule, where:

- 50% of your income goes to needs (rent, utilities, groceries),

- 30% goes to wants (dining out, entertainment),

- 20% goes to savings and debt repayment.

Budgeting Tips

- Track Every Expense: Use budgeting apps or spreadsheets to track every penny you spend.

- Adjust as Needed: Budgets are dynamic. Don’t hesitate to adjust your budget as your financial situation changes.

- Automate Savings: Set up automatic transfers to your savings account to ensure you pay yourself first.

Building an Emergency Fund

An emergency fund acts as a financial safety net for unexpected expenses such as medical bills, car repairs, or sudden job loss. Aim to save at least three to six months’ worth of living expenses.

How to Build an Emergency Fund

- Set a Monthly Savings Goal: Decide on a realistic amount to save each month.

- Cut Unnecessary Expenses: Identify and reduce non-essential spending to boost your savings.

- Automate Savings: Use automatic transfers to ensure consistency in saving.

Managing Debt

Debt can be a significant burden, but with a structured plan, you can manage and eliminate it over time.

Debt Repayment Strategies

- Avalanche Method: Pay off the debt with the highest interest rate first while making minimum payments on the rest.

- Snowball Method: Pay off the smallest debt first to build momentum, then move on to larger ones.

Negotiating with Creditors

Don’t hesitate to reach out to your creditors. Often, they may be willing to lower interest rates or offer more manageable repayment plans if you communicate proactively.

Saving for Your Child’s Future

As a single parent, securing your child’s future is likely high on your priority list.

Education Savings

Consider using savings plans like a 529 plan, which offers tax advantages for education savings. Regularly contribute to this account to build a substantial fund over time.

Custodial Accounts

Custodial accounts, such as UGMA/UTMA accounts, allow you to put away money in your child’s name for future expenses, be it education, a first car, or their first home.

Involving Your Child

Teach your child about money management from an early age. It’s never too early to involve them in age-appropriate financial decisions.

Insurance and Protection

Insurance is crucial for protecting your family’s financial stability.

Health Insurance

Ensure you have adequate health insurance to cover medical expenses for you and your family. Look into government programs if you’re eligible for assistance.

Life Insurance

Consider term life insurance to provide financial protection for your children in case something happens to you. It’s essential to ensure your children’s guardians have the financial support they need.

Disability Insurance

Disability insurance replaces a portion of your income if you become unable to work due to illness or injury. This ensures you have financial support when you can’t work.

Planning for Retirement

Even as a single parent, planning for retirement is crucial. You want to secure your future as well.

Employer-Sponsored Plans

If you have access to a 401(k) or similar plan, contribute enough to get any employer match. This is essentially free money that can grow over time.

IRAs

Consider opening an Individual Retirement Account (IRA) if you don’t have an employer-sponsored plan or want to supplement it. Traditional and Roth IRAs offer different tax advantages.

Stay Consistent

Make regular contributions to your retirement account, and avoid dipping into these funds for other expenses.

Maximizing Income

Boosting your income can help you achieve your financial goals faster.

Side Hustles

Explore side hustles that fit your skills and time availability. This could include freelance work, tutoring, or selling handmade crafts.

Upskilling

Invest in your education and skills to open up opportunities for promotions or higher-paying job roles.

Tax Credits and Benefits

Take advantage of tax credits and benefits available to single parents, such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). These can provide significant financial relief.

Seeking Professional Help

If managing finances feels overwhelming, seeking professional help can be a wise decision.

Financial Advisors

A financial advisor can offer personalized advice tailored to your unique situation. They can help with budgeting, saving, investing, and planning for the future.

Legal Advisors

Consult a legal advisor for matters related to alimony, child support, and wills. Ensuring these legalities are in place can provide peace of mind.

Support Groups

Join support groups for single parents. These communities can offer valuable support and share tips on managing finances and parenting.

Staying Motivated and Adjusting Your Plan

A financial plan isn’t a set-it-and-forget-it task. It’s vital to stay motivated and adjust your plan as life changes.

Monitoring Progress

Regularly review your financial progress. This can be weekly, monthly, or quarterly. Use this time to reassess your goals and make necessary adjustments.

Celebrating Milestones

Celebrate small wins! Did you pay off a debt or hit a savings goal? Acknowledge and reward yourself for these achievements to stay motivated.

Adapting to Changes

Life as a single parent can be unpredictable. Be prepared to adapt your financial plan to changing circumstances, such as a job change, a new expense, or a shift in child support.

Conclusion

Creating a financial plan as a single parent might seem daunting, but it’s entirely achievable with the right strategies and mindset. By understanding your financial situation, setting clear goals, budgeting wisely, saving for emergencies, managing debt, and seeking professional help, you can build a secure financial future for you and your children. Remember, you are capable, and your efforts today will lay the foundation for a brighter tomorrow. Happy planning!