Understanding Inflation: How It Affects Your Money

Understanding inflation is crucial for managing your finances effectively. In “Understanding Inflation: How It Affects Your Money,” you’ll discover how inflation can influence your savings, the cost of goods, and your overall purchasing power. This friendly guide will walk you through the basics of inflation, helping you understand why prices rise over time, how it impacts your daily life, and what you can do to protect your financial wellbeing. By grasping these concepts, you’ll be better equipped to make informed decisions and keep your money working for you.

Have you ever wondered why the cost of your favorite coffee has gone up over the years or why a candy bar costs way more now than it did when you were a child? If you have, you’re not alone. The answer to these questions revolves around a concept known as inflation. Understanding inflation can help you make better financial decisions and plan for the future. In this article, we’ll dive deep into what inflation is, how it works, why it happens, and most importantly, how it affects your money.

What is Inflation?

Inflation is a term you hear all the time, but what does it actually mean? Simply put, inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power over time. When inflation occurs, each unit of currency buys fewer goods and services than it did in the past.

The Basics of Inflation

Inflation is typically expressed as an annual percentage rate. For example, if inflation is said to be 3%, it means that prices on average are 3% higher than they were a year ago. The key takeaway here is that inflation reduces the value of money over time.

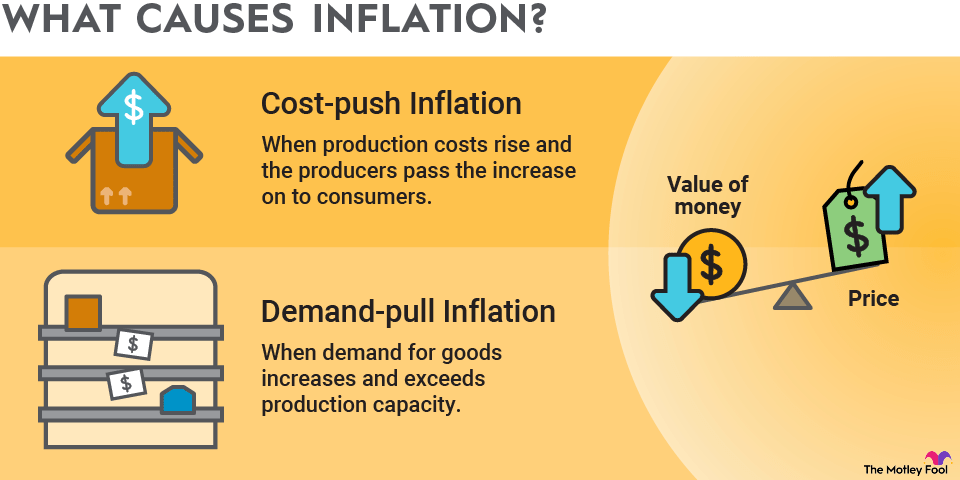

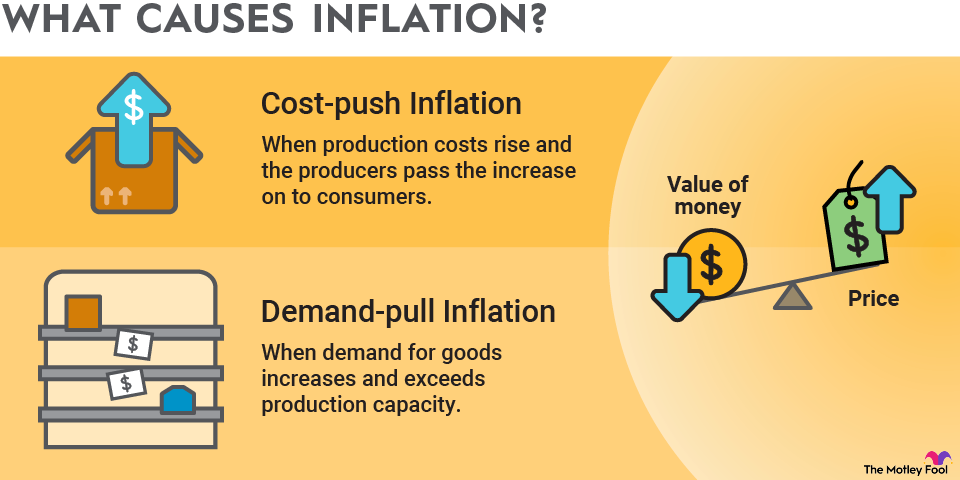

Types of Inflation

- Demand-Pull Inflation: This occurs when demand for goods and services exceeds their supply. When everyone wants to buy the new smartphone but there aren’t enough available, prices go up.

- Cost-Push Inflation: This happens when the cost to produce goods and services increases. For instance, if the price of oil rises, it can make manufacturing products more expensive, leading to higher prices for consumers.

- Built-In Inflation: This is related to the adaptive expectations of workers and businesses. If workers expect prices to rise, they may demand higher wages, leading businesses to increase prices to compensate, thereby creating a cycle of rising prices and wages.

Measuring Inflation

Now that you know what inflation is, you might wonder how it is measured. There are a few key indices used to measure inflation, each with a slightly different focus.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures changes in the price level of a market basket of consumer goods and services purchased by households. When people talk about inflation in the news, they are usually referring to changes in the CPI.

Here’s a table to make things clearer:

| Category | Example Items Included |

|---|---|

| Food and Beverages | Groceries, dining out |

| Housing | Rent, home ownership expenses |

| Apparel | Clothing, footwear |

| Transportation | Fuel, cars, public transportation |

| Medical Care | Doctor’s visits, prescription drugs |

| Recreation | Movies, sporting events |

| Education | Tuition, textbooks |

| Other Goods/Services | Haircuts, funeral expenses |

Producer Price Index (PPI)

The Producer Price Index (PPI) measures the average change over time in selling prices received by domestic producers for their output. While CPI looks at the cost from the consumer’s perspective, PPI focuses on the seller’s viewpoint.

Personal Consumption Expenditures (PCE)

The PCE Price Index is another measure of consumer inflation tracking changes in the prices of goods and services consumed by all households. It’s often used by policymakers to understand inflation trends better.

:max_bytes(150000):strip_icc()/how-inflation-affects-your-cost-living.asp_V2-b11e1ddb3ca24bb18e2a66c23b9ee0a6.png)

Causes of Inflation

Understanding the root causes of inflation can help you prepare and adapt your financial strategies accordingly. Here are the primary drivers:

Monetary Policy

Central banks, such as the Federal Reserve in the United States, play a major role in managing inflation. They control the money supply and interest rates to either stimulate or cool down the economy. When the money supply grows too rapidly, it can lead to inflation.

Supply and Demand

Basic economic principles state that when demand exceeds supply, prices rise, leading to inflation. This can be triggered by various factors, including economic growth, increased consumer spending, and more.

Cost of Production

If the cost to produce goods and services increases, this often leads to higher prices for consumers. This could be due to increased labor costs, higher costs of raw materials, or tariffs on imported goods.

Global Factors

Global events such as wars, trade tensions, or natural disasters can disrupt supply chains and affect the availability of goods, contributing to inflation. For instance, a major oil-producing country experiencing political instability can lead to higher global oil prices, impacting various sectors.

How Inflation Affects Your Money

Now you understand what inflation is and why it happens. But how does it affect your everyday life and money? The impacts can be wide-ranging and can influence everything from your savings to your investment strategies.

Eroding Purchasing Power

The most direct effect of inflation is that it erodes your purchasing power. If your income doesn’t increase at the same rate as inflation, you’ll find that you can buy less with the same amount of money over time. This can affect your ability to afford essential goods and services.

Impact on Savings

If you keep your money in a savings account that offers a low-interest rate, the value of your savings can diminish over time due to inflation. For example, if your savings account offers a 1% interest rate but the inflation rate is 3%, you are effectively losing 2% of your money’s value each year.

Influence on Investments

Inflation affects various types of investments differently. While inflation can be detrimental to fixed-income investments like bonds, it can benefit assets that tend to increase in value over time, such as real estate and stocks.

Cost of Borrowing

Inflation can also impact the cost of borrowing money. When inflation is high, central banks may increase interest rates to control it, making loans and mortgages more expensive.

Strategies to Combat Inflation

While inflation is inevitable, there are strategies you can adopt to mitigate its impact on your financial health.

Diversify Your Investments

One way to shield yourself from inflation is to diversify your investments. Assets such as stocks, real estate, and commodities can offer better returns that outpace inflation.

Invest in Inflation-Protected Securities

In the U.S., Treasury Inflation-Protected Securities (TIPS) are bonds that adjust in value based on inflation, offering a government-backed way to protect your money’s value.

Increase Earnings

To keep up with inflation, aim to increase your earnings. This could be through salary negotiations, obtaining higher education or certifications, or starting a side business.

Minimize Debt

High-interest debts can become more burdensome when inflation rises. Paying down your debt can help you manage better during inflationary periods.

The Role of Government and Central Banks

Governments and central banks play a crucial role in managing inflation. They utilize various tools and techniques to keep inflation within a manageable range.

Monetary Policy

Central banks use monetary policy to control the money supply and influence interest rates. During high inflation, they may raise interest rates to cool down overheating economies.

Fiscal Policy

Governments can also influence inflation through fiscal policy. They can adjust spending levels and tax rates to either stimulate or slow economic growth.

Inflation Targets

Many central banks set inflation targets to guide their monetary policies. For instance, the Federal Reserve aims for a 2% inflation rate, which is considered stable and promotes sustainable economic growth.

Historical Examples of Inflation

Looking at historical examples of inflation can give you a better understanding of its impact and how different nations have dealt with it.

Hyperinflation in Zimbabwe

One of the most extreme cases of hyperinflation occurred in Zimbabwe in the late 2000s. At its peak, the inflation rate skyrocketed to 89.7 sextillion percent per month. The government had to abandon its currency and adopt foreign currencies to stabilize the economy.

The Great Inflation (1965-1982)

In the United States, the period from 1965 to 1982 was marked by high inflation rates. Several factors contributed to this, including increased government spending on the Vietnam War and social programs, as well as rising oil prices. The Federal Reserve eventually controlled inflation through strict monetary policies.

Post World War I Germany

Germany experienced hyperinflation after World War I, partly due to the reparations demanded by the Treaty of Versailles. By 1923, the German mark had lost so much value that people used it as wallpaper or paper toys for children. The government introduced a new currency to stabilize the economy.

Inflation in Different Economies

Inflation doesn’t affect all economies equally. Developing countries often experience higher rates of inflation compared to developed nations. This can be due to a variety of factors, including less stable political environments, higher dependency on commodity imports, and less effective monetary policies.

Developed Economies

Developed economies tend to have more stable inflation rates. Central banks with strong policy tools and credible governance can keep inflation within targeted ranges. For instance, the Eurozone and Japan have successfully managed to maintain relatively low and stable inflation rates over the years.

Developing Economies

Developing economies often face higher and more volatile inflation rates. Factors like political instability, economic sanctions, and underdeveloped financial markets contribute to this volatility. For example, inflation has historically been higher in countries like Venezuela and Argentina.

Future Trends

Predicting future trends in inflation can be challenging, but several factors can give us an indication of where it might be headed.

Technological Advancements

Technology can influence inflation in multiple ways. Improved productivity and automation can lower production costs, helping to keep inflation in check. On the other hand, rapid technological advancements can create new industries and increase demand for certain goods and services, potentially driving prices up.

Demographics

The age distribution of a population can also affect inflation. Aging populations may lead to higher healthcare and social security costs, putting upward pressure on prices. Conversely, younger, more productive populations can stimulate economic growth and reduce inflationary pressures.

Globalization

Globalization has often served as a dampening force on inflation. By opening markets and increasing competition, prices are kept lower. However, shifting trade policies and geopolitical tensions could disrupt this trend, leading to higher inflation in the future.

Conclusion

Understanding inflation is crucial for making informed financial decisions. It’s a complex phenomenon influenced by various factors, from monetary policy to global events. By keeping an eye on inflation measures like the Consumer Price Index and diversifying your investments, you can protect your money’s value over time. Remember, inflation is a natural part of economic cycles, but with the right strategies, you can mitigate its impact on your financial health.

So, the next time you’re sipping on your slightly more expensive coffee, you’ll have a better understanding of the forces at play and how to navigate them. Stay informed, stay proactive, and you’ll be well-prepared to tackle the challenges inflation brings.