The Importance Of Financial Independence: Achieving Your Goals

In “The Importance Of Financial Independence: Achieving Your Goals,” you’re taken on a journey to understand why taking control of your finances is critical for turning your dreams into reality. The article emphasizes how financial independence empowers you to make life decisions without being constrained by monetary concerns. By exploring practical strategies and tips, it offers you the tools to create a stable financial future, ensuring that you can focus on achieving your goals and living the life you’ve always envisioned.

Have you ever wondered how it would feel to achieve complete financial independence? To have the freedom and peace of mind that comes from knowing you can handle whatever life throws at you without worrying about money? In this friendly and informative guide, we’re going to explore “The Importance of Financial Independence: Achieving Your Goals.”

Understanding Financial Independence

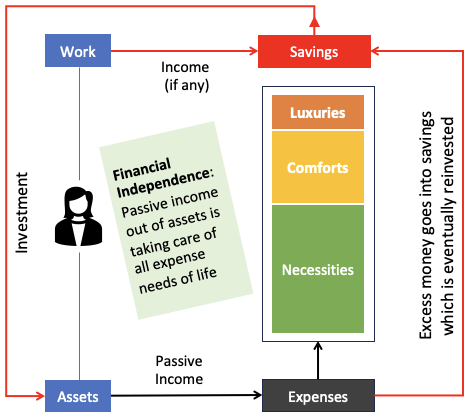

Financial independence means having enough financial resources to cover your living expenses for the rest of your life without needing to work. It’s about having the security and freedom to make choices that aren’t driven by financial constraints. Achieving financial independence typically involves saving and investing money wisely, reducing debt, and creating sustainable income streams.

Why is Financial Independence Important?

Financial independence is crucial for several reasons:

- Security: It provides a sense of security, knowing that you can handle emergencies, job loss, or other unexpected events.

- Freedom: You have the freedom to make choices based on what you want to do rather than what you have to do for money.

- Quality of Life: It allows you to pursue hobbies, travel, spend time with family, or even start a new business without financial stress.

Steps to Achieving Financial Independence

Achieving financial independence doesn’t happen overnight. It requires planning, discipline, and persistence. Here are some essential steps you can take:

1. Set Clear Financial Goals

Start by defining what financial independence means to you. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals. These might include paying off debt, saving for a down payment on a house, or building an emergency fund.

2. Create a Budget

Creating a budget helps you understand where your money is going and identify areas where you can cut back. Make sure to track your expenses and stick to your budget as closely as possible.

Sample Budget Table

| Category | Monthly Allocation | Actual Spending |

|---|---|---|

| Housing | $1,200 | $1,150 |

| Transportation | $300 | $275 |

| Food | $400 | $380 |

| Utilities | $200 | $190 |

| Savings | $500 | $500 |

| Entertainment | $100 | $95 |

| Miscellaneous | $100 | $80 |

| Total | $2,800 | $2,670 |

3. Reduce and Manage Debt

Debt can be a significant obstacle to financial independence. Focus on paying off high-interest debt first and explore debt consolidation options if necessary. Create a debt repayment plan and stick to it.

4. Build an Emergency Fund

An emergency fund is a crucial part of financial independence. Aim to save at least three to six months’ worth of living expenses in a liquid, interest-bearing account. This fund will provide a financial cushion in case of emergencies.

5. Invest Wisely

Investing is essential for growing your wealth over time. Educate yourself about different investment options such as stocks, bonds, real estate, and retirement accounts. Diversify your investments to manage risk better.

6. Save for Retirement

Maximize your contributions to retirement accounts such as a 401(k) or IRA. Take advantage of employer matches if available. The earlier you start saving for retirement, the more time your money has to grow.

7. Monitor and Adjust Your Plan

Regularly review your financial plan and make adjustments as needed. Life changes, and so should your financial strategies. Stay informed about economic trends and adjust your investments and savings accordingly.

Overcoming Obstacles to Financial Independence

Achieving financial independence is not without its challenges. Here are some common obstacles and how to overcome them:

Lack of Financial Literacy

Many people struggle with financial independence due to a lack of financial literacy. Educate yourself through books, online courses, or by speaking with a financial advisor. Knowledge is power when it comes to managing your finances.

Unforeseen Expenses

Unexpected expenses can derail your financial plans. Having an emergency fund and adequate insurance coverage can help mitigate these risks.

Lifestyle Inflation

As your income grows, it’s tempting to increase your spending. Avoid lifestyle inflation by keeping your living expenses consistent and directing additional income towards savings and investments.

Importance of a Growth Mindset

A growth mindset is crucial for achieving financial independence. Believe in your ability to improve your financial situation. Embrace challenges as opportunities to learn and grow.

Benefits of Financial Independence

The benefits of achieving financial independence are plentiful:

Reduced Stress

Financial worries are a significant source of stress for many people. Financial independence can alleviate these worries, leading to better mental and physical health.

Flexibility

Having financial resources gives you the flexibility to pursue new opportunities, whether it’s a different career path, starting a business, or traveling the world.

Ability to Help Others

Financial independence also allows you to support loved ones or contribute to charitable causes. Giving back can be one of the most rewarding aspects of financial success.

Common Myths About Financial Independence

There are several myths about financial independence that can hold you back. Let’s debunk a few:

Myth 1: You Need a High Income to Achieve Financial Independence

While a high income can help, it’s not the only path to financial independence. What’s more important is how you manage and invest your money.

Myth 2: You Have to Sacrifice Enjoyment

Achieving financial independence doesn’t mean you have to live a life of deprivation. It’s about finding a balance between enjoying the present and planning for the future.

Myth 3: It’s Too Late to Start

It’s never too late to start working towards financial independence. While starting early has its advantages, making positive financial changes at any stage of life can lead to significant improvements.

:max_bytes(150000):strip_icc()/financial-independence-retire-early-fire-c928050718c9429584e88a5df23ebb1d.jpg)

Tools and Resources for Achieving Financial Independence

Here are some tools and resources that can help you on your journey:

Budgeting Apps

- Mint: Helps you track expenses and create budgets.

- YNAB (You Need A Budget): Encourages proactive budgeting by assigning every dollar a job.

- Personal Capital: Offers financial planning and wealth management tools.

Investment Platforms

- Betterment: An online investment platform offering personalized financial advice.

- Vanguard: Known for low-cost mutual funds and ETFs.

- Fidelity: Offers a wide range of investment options and educational resources.

Financial Books

- Rich Dad Poor Dad by Robert Kiyosaki: Offers insights into financial literacy and investing.

- The Total Money Makeover by Dave Ramsey: Provides a plan for getting out of debt and building wealth.

- Your Money or Your Life by Vicki Robin and Joe Dominguez: Focuses on transforming your relationship with money.

Real-Life Examples of Financial Independence

Hearing real-life stories of people who have achieved financial independence can be incredibly motivating. Here are a few examples:

Story 1: Sarah’s Journey to Debt-Free Living

Sarah, a single mother, managed to pay off $50,000 in debt within three years. She achieved this by creating a strict budget, taking on a second job, and selling unnecessary possessions. Today, she is debt-free and has a growing investment portfolio.

Story 2: John and Emily’s Early Retirement

John and Emily decided to pursue early retirement in their 40s. They focused on living below their means, saving aggressively, and investing in low-cost index funds. Now, they travel the world while living off their investment income.

Story 3: Michael’s Successful Business Venture

Michael always dreamt of starting his own business. He saved and invested strategically while working a corporate job. Once he had enough savings and investments to cover his living expenses, he took the leap. His business thrived, and he achieved financial independence within five years.

Final Thoughts

Achieving financial independence is a journey that requires planning, discipline, and a willingness to learn. By setting clear goals, creating a budget, reducing debt, building an emergency fund, investing wisely, and saving for retirement, you can work towards financial independence and the freedom it brings.

Remember, it’s not about how much you earn but how well you manage and grow your money. With persistence and the right mindset, you can achieve your financial goals and enjoy the numerous benefits of financial independence.

So, are you ready to take control of your financial future and achieve the independence you’ve always dreamed of? The journey starts now!