How To Save Money On Healthcare Costs

How to Save Money on Healthcare Costs” offers you practical tips to navigate the often overwhelming world of healthcare expenses. In this insightful guide, you’ll explore various strategies to reduce your medical bills, from choosing the right insurance plan to making smart decisions on preventative care. Whether you’re looking to cut down on co-pays, negotiate medical bills, or make the most of your health savings account, this article empowers you with the knowledge you need to make healthcare more affordable without compromising on quality.

Have you ever found yourself overwhelmed by the high costs of healthcare? You’re definitely not alone. The continuously rising costs can make it challenging to afford the care you need. But don’t worry, because we have some friendly and practical tips that can help you save money on healthcare without sacrificing your well-being. Let’s dive into how you can cut down on healthcare expenses while still receiving quality care.

Understanding Your Healthcare Costs

Before we jump into the nitty-gritty, it’s crucial to understand where your money is going when it comes to healthcare. By understanding various components of healthcare costs, you can identify areas where you can save.

Types of Healthcare Costs

- Premiums: Regular payments you make to maintain your health insurance.

- Deductibles: The amount you pay out-of-pocket before your insurance starts covering expenses.

- Co-pays: Fixed fees you pay for specific services, like doctor visits or prescriptions.

- Coinsurance: A percentage of the cost of a service that you’re responsible for, after meeting your deductible.

Choose the Right Health Insurance Plan

Choosing the right health insurance plan can be one of the most effective ways to save on healthcare costs.

Evaluate Your Needs

Consider your health needs and those of your family. If you frequently visit the doctor or require medications, a plan with a higher premium but lower deductible might be more cost-effective for you.

Compare Plans

Don’t just settle for the first plan you find. Compare multiple plans using online tools or consult an insurance agent to find one that offers the best value for your needs.

| Plan Type | Monthly Premium | Deductible | Co-pay | Networks | Ideal For |

|---|---|---|---|---|---|

| High Deductible | Lower | Higher | Variable | Limited | Generally healthy individuals |

| Low Deductible | Higher | Lower | Fixed | Extensive | Regular healthcare users |

| HMO | Moderate | Moderate | Fixed | Highly-limited | Those who don’t mind network restrictions |

| PPO | Higher | Lower | Higher | Extensive | Those who want flexibility |

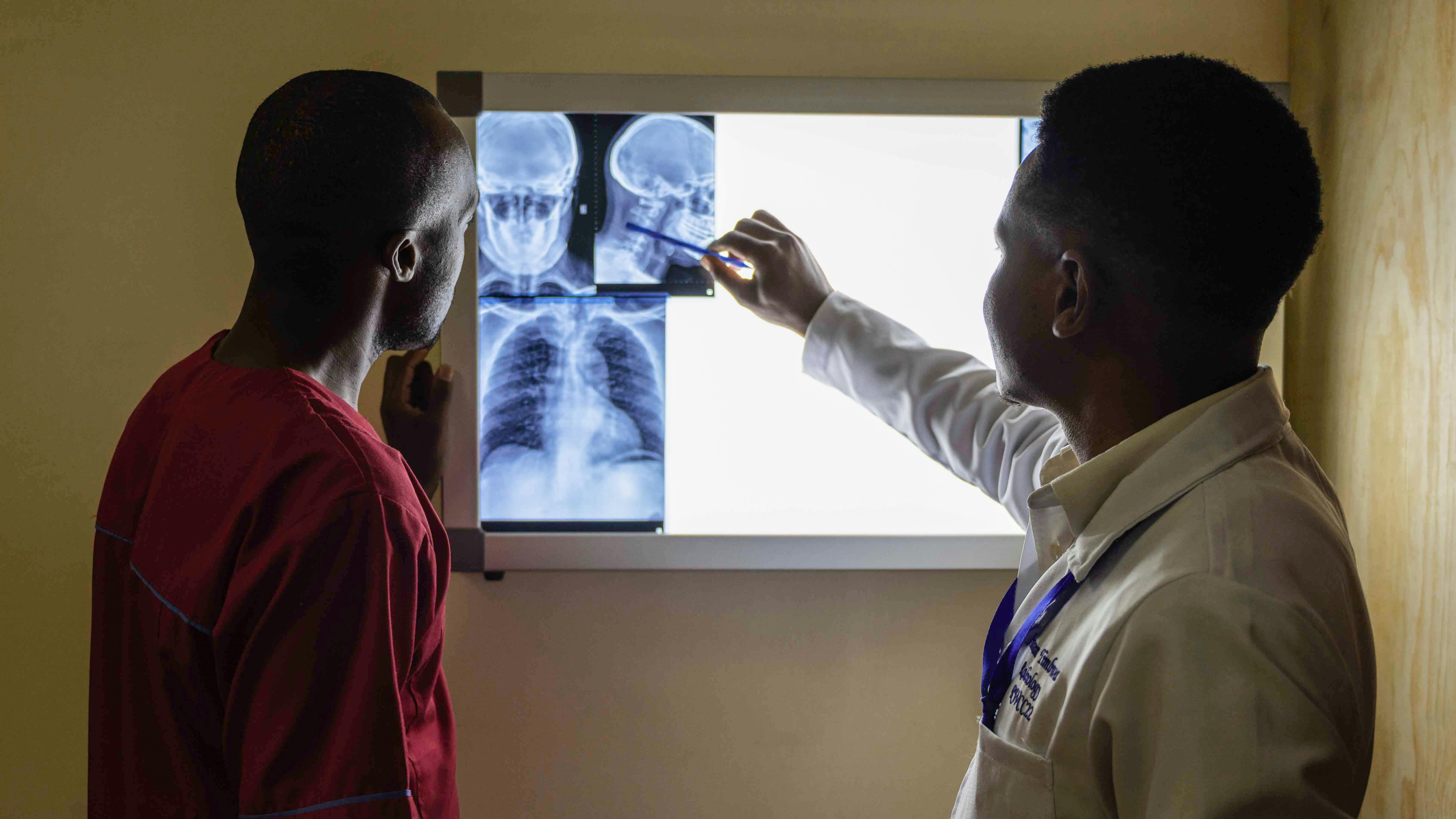

Use Preventative Care

Preventative care is care you get to prevent illnesses or detect them at an early stage when treatment is likely to work best. This is often covered at no cost by most insurance plans.

Schedule Regular Check-Ups

Regular check-ups can catch potential health issues early, often saving you money in the long run.

Vaccinations and Immunizations

Vaccinations can prevent costly diseases, which will save you much more than the cost of the vaccine itself.

Utilize Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are special accounts you can use to pay for certain out-of-pocket healthcare costs.

Health Savings Accounts (HSAs)

HSAs allow you to save pre-tax money for medical expenses. Funds can roll over year-to-year if you don’t spend them. HSAs are available only with high-deductible health plans (HDHPs).

Flexible Spending Accounts (FSAs)

FSAs also let you save pre-tax money, but you must use the funds within the plan year or risk losing them. FSAs are compatible with any type of health insurance plan.

Opt for Generic Medications

Generic medications are just as effective as their brand-name counterparts and are significantly cheaper.

Ask Your Doctor

Always ask your healthcare provider if a generic option is available for any prescription they plan to give you.

Compare Pharmacies

Not all pharmacies charge the same price for prescription drugs, so it’s worth pricing out your medications at a few different locations.

Choose In-Network Providers

Staying within your insurance network can drastically reduce your out-of-pocket costs.

Verify Your Provider

Always verify that your healthcare providers are in-network before receiving services. This can usually be done through your insurance company’s website or by calling the provider directly.

Ask for Discounts

Don’t hesitate to ask if there are any discounts available for paying in cash or for prompt payment. Many providers offer incentives that can save you money.

Take Advantage of Telemedicine

Telemedicine is a convenient and often less expensive way to consult with healthcare professionals.

When to Use Telemedicine

Use telemedicine for minor health issues, routine follow-ups, and mental health consultations.

| Telemedicine Service | Common Uses | Cost Comparison (In-Person) |

|---|---|---|

| Video Consultations | Minor illnesses, follow-ups | Often lower than in-person |

| E-mail Advice | Prescription refills, advice | Typically low or no cost |

| Mental Health | Therapy, counseling | Frequently less expensive |

Be Proactive About Your Health

Living a healthy lifestyle can prevent many diseases and reduce the need for medical care.

Exercise Regularly

Regular physical activity can help maintain your weight, improve your mood, and prevent chronic diseases.

Eat a Balanced Diet

Eating a well-balanced diet rich in fruits, vegetables, and lean proteins can improve your overall health and reduce the need for medical intervention.

Avoid Smoking and Limit Alcohol

Smoking and excessive alcohol consumption can lead to significant health issues, which are expensive to treat. Quitting smoking and reducing alcohol intake can save you money and improve your quality of life.

Negotiate Medical Bills

Don’t assume that medical bills are set in stone. Often, there’s room for negotiation.

Review Your Bills

Carefully review any medical bills you receive to ensure they are accurate. Errors can happen, and you should dispute incorrect charges.

Payment Plans

Talk to your healthcare provider’s billing department about payment plans or financial assistance programs. Many providers offer these options to help manage expenses.

Participate in Wellness Programs

Many employers and health insurance plans offer wellness programs that provide financial incentives for healthy behaviors.

Benefits of Wellness Programs

These programs can include fitness challenges, smoking cessation programs, and health coaching, often reducing your premiums or offering cash rewards.

How to Join

Check with your employer or insurance carrier to see what wellness programs are available and how you can participate.

Buy in Bulk and Shop Around

For long-term medications or medical supplies, buying in bulk can save you significant amounts of money.

Bulk Purchasing

If you’re prescribed a medication you’ll be taking for an extended period, ask your doctor if you can get a 90-day supply rather than a 30-day one.

Shop for Competitive Prices

Use websites and apps that compare prescription drug prices or medical supply costs across different pharmacies and stores.

Understand Your Bills and Statements

Healthcare billing can be complex, but understanding your bills and insurance statements can help you spot errors and unnecessary charges.

Explanation of Benefits (EOB)

EOBs from your insurance company will help you understand what was billed, what your insurance covered, and what you owe. Always review these statements carefully.

Seek Professional Help

If you have trouble understanding your bills, consider hiring a medical billing advocate. They can help ensure that you’re not overcharged and may assist with negotiating lower costs.

Participate in Clinical Trials

Participating in clinical trials can give you access to cutting-edge treatments at no cost.

How to Find Clinical Trials

Check sites like ClinicalTrials.gov to find trials for conditions you may have. Discuss with your healthcare provider if participating in a clinical trial is a suitable option for you.

Travel for Medical Procedures

Sometimes traveling to another city, state, or even country for a medical procedure can be cost-effective.

Medical Tourism

Medical tourism can be a viable option for expensive procedures. Research and choose accredited hospitals or clinics to ensure quality care.

Local Travel

Even within your country, different regions may have varying healthcare costs. If it’s feasible, consider traveling to a less expensive area for elective procedures to save money.

Educate Yourself About Healthcare

Knowledge is power, especially when it comes to healthcare.

Stay Informed

Read books, articles, and trusted websites about conditions you or your loved ones may have. Understanding your condition can help you make informed decisions that save money.

Ask Questions

Don’t be afraid to ask your healthcare provider questions about your treatment options, costs, and alternative therapies. The more you know, the better decisions you can make.

Utilize Community Resources

Many communities offer resources that can help you save on healthcare costs.

Free Clinics

Free clinics or community health centers often provide services to those with low incomes or without insurance.

Health Fairs

Participate in local health fairs that offer free screenings and wellness check-ups.

By adopting these strategies, you can significantly reduce your healthcare costs and ease the financial burden. Remember, a proactive approach to your health and healthcare expenses can go a long way in saving you money while maintaining your well-being. In the end, taking control of your healthcare can be both empowering and financially beneficial. Enjoy the newfound peace of mind that comes with smarter healthcare spending!