Renting Vs. Buying: Deciding What’s Right For You At Every Stage Of Life

Are you at a crossroads in your life, unsure whether to rent or buy a home? Look no further, as we explore the timeless debate of renting versus buying and help you make the right decision for every stage of your life. From the excitement of starting your career to the joys of retirement, we provide insights and advice to guide you through this crucial decision-making process. Whether you crave the freedom and flexibility of renting or dream of owning your own piece of property, this article serves as your friendly companion, offering practical tips and considerations to help you navigate the complex world of real estate.

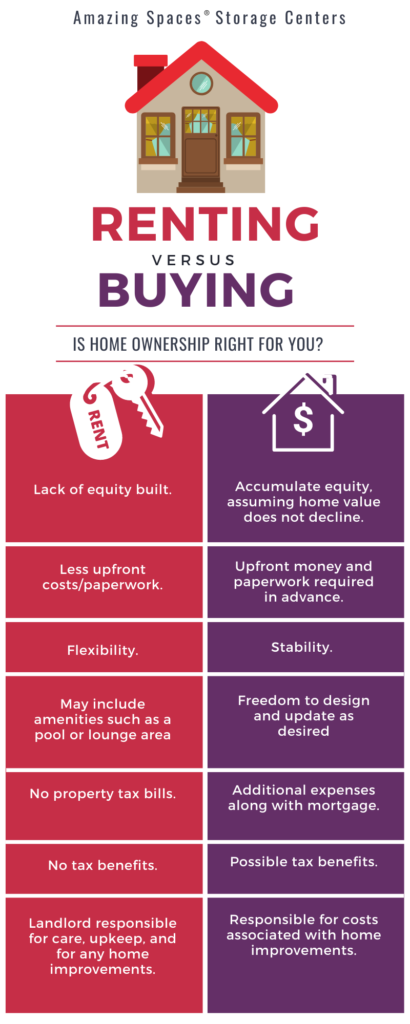

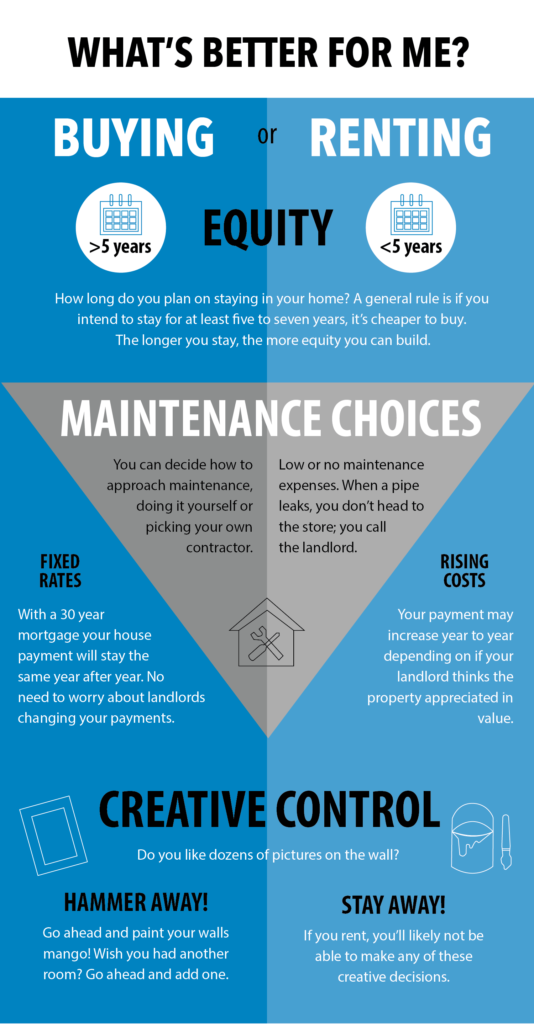

This image is property of amazingspaces.com.

1. Renting vs. Buying: An Overview

Understanding the concept of renting

Renting a property involves paying a monthly rent to a landlord in exchange for the right to live in the property. It offers flexibility, as the lease term is usually shorter and allows for easy relocation. Renting is suitable for individuals who prioritize mobility and don’t want the long-term commitment of homeownership.

Understanding the concept of buying

Buying a property involves purchasing a home, typically with the help of a mortgage, and becoming the owner. This option provides stability and the opportunity to build equity over time. Homeowners have the freedom to personalize their space and make changes according to their preferences.

Factors to consider when deciding between renting and buying

Several factors should be taken into account when deciding whether to rent or buy a property. Financial stability, long-term goals, personal preferences, and the analysis of the current real estate market are crucial considerations. Seeking professional advice can also help individuals make an informed decision that aligns with their specific circumstances.

2. Advantages of Renting

Flexibility and mobility

Renting offers immense flexibility, particularly for individuals who anticipate career or lifestyle changes. Lease terms are often shorter, allowing renters to relocate more easily. This flexibility can be especially beneficial for young professionals or individuals who are uncertain about their long-term plans.

Maintenance and repair responsibilities

One of the notable advantages of renting is that maintenance and repair responsibilities typically fall on the landlord. Tenants can rest assured that issues with plumbing, electrical systems, or appliances are the landlord’s responsibility, freeing them from the burden of costly repairs.

Lower upfront costs

Renting usually requires lower upfront costs compared to buying. While renters are still responsible for the security deposit and sometimes the first and last month’s rent, these amounts are generally more affordable than a down payment for a mortgage. This makes renting a more accessible option for those with limited savings or are not yet ready to commit to homeownership.

Opportunity to live in desired locations

Renting allows individuals to live in desired locations that may be financially out of reach for homeownership. It provides the opportunity to experience different neighborhoods, cities, or even countries without the long-term commitment associated with buying a property. This flexibility can be particularly attractive for individuals seeking vibrant city living or proximity to specific amenities.

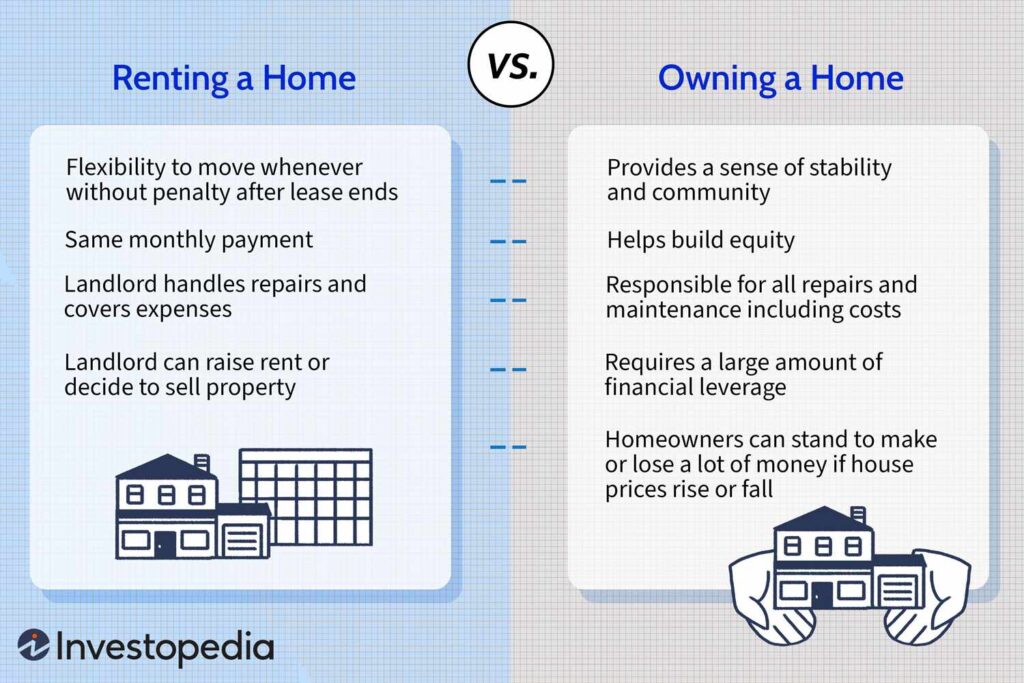

This image is property of www.investopedia.com.

3. Disadvantages of Renting

Lack of ownership and equity building

One of the main disadvantages of renting is the lack of ownership and the inability to build equity. Renters do not accumulate value in the property over time as homeowners do. Instead, they are essentially paying for the right to live in someone else’s property without the long-term financial benefits that come with homeownership.

Limited customization and personalization

Renting often comes with limitations on customization and personalization. Tenants may have restrictions imposed by landlords regarding painting, renovations, or even the types of pets allowed. This can hinder individuals’ ability to make the space truly feel like their own and may limit their ability to create a home that aligns with their unique preferences.

Potential rent increases and instability

Renters face the possibility of rent increases at the end of each lease term. Landlords may increase rent prices, sometimes significantly, leaving renters with higher monthly expenses. Additionally, renting provides less stability compared to owning a home since landlords can decide not to renew a lease or sell the property, necessitating a move.

Restricted control over the property

As renters, individuals have limited control over the property. Major decisions such as selling or making significant changes to the property are under the landlord’s purview. This lack of control can limit renters’ ability to create a living environment that perfectly suits their needs and preferences.

4. Advantages of Buying

Building equity and property ownership

One of the most significant advantages of buying a property is the opportunity to build equity and become a homeowner. Each mortgage payment made contributes towards building equity, which can serve as a valuable asset in the long run. Homeownership allows individuals to accumulate wealth and have an investment that can appreciate in value over time.

Potential for property value appreciation

Homeowners also benefit from the potential for property value appreciation. As the real estate market fluctuates, there is the possibility that the value of their property may increase, allowing homeowners to reap financial gains when they choose to sell. This potential for appreciation can be a considerable advantage in the long term.

Personalization and customization options

Owning a home provides individuals with the freedom to personalize and customize their living space. Homeowners can make changes, such as renovations, painting, or landscaping, to reflect their personal style and preferences. This ability to create a home tailored to their liking is a significant advantage for those who value customization.

Stability and control over the property

One of the key advantages of buying a property is the stability and control it provides homeowners. Unlike renting, homeownership offers the reassurance of long-term residence and the ability to settle down in one place. Homeowners have the authority to make decisions regarding the property, giving them a sense of stability and control over their living space.

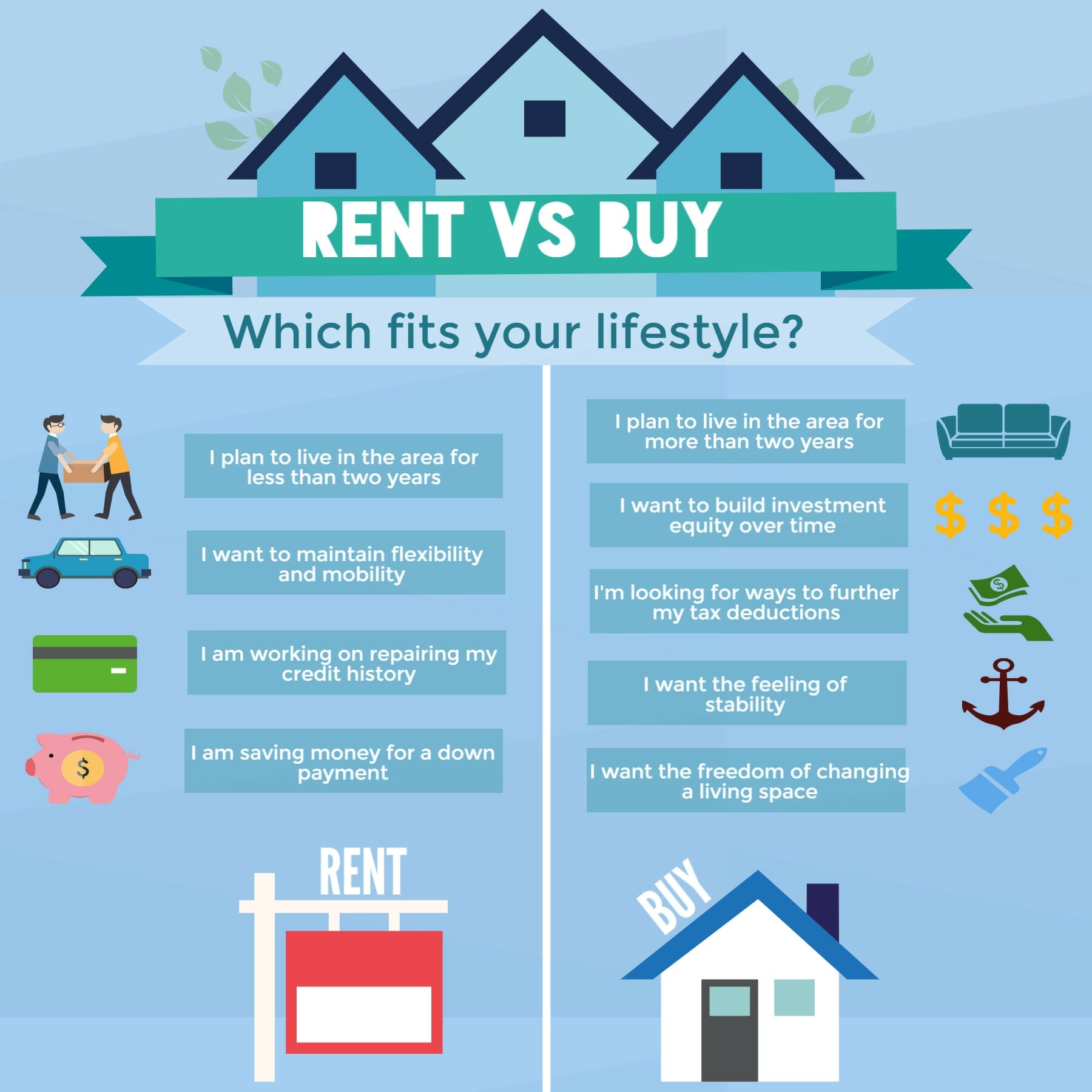

This image is property of www.listenmoneymatters.com.

5. Disadvantages of Buying

Higher upfront costs

Buying a property typically requires a higher upfront cost compared to renting. This includes the down payment, closing costs, and other associated fees. Accumulating the necessary funds can be challenging for some individuals and may require long-term saving or assistance from financial institutions.

Responsibility for maintenance and repairs

Homeowners are responsible for all maintenance and repair costs. Any issues that arise, including appliance malfunctions, structural repairs, or plumbing problems, are the homeowner’s responsibility to resolve. These expenses can be unexpected and may have an impact on the homeowner’s financial stability.

Less flexibility and mobility

Unlike renting, owning a home limits flexibility and mobility. Homeowners cannot simply relocate without considering the impact on their property and financial commitments. This lack of flexibility can pose challenges for individuals who anticipate frequent relocations or changes in lifestyle.

Potential financial risks and market fluctuation

Homeownership carries potential financial risks, particularly in a fluctuating real estate market. The value of a property can decrease, affecting the homeowner’s investment. Additionally, unforeseen circumstances such as job loss or economic downturns can make it difficult for homeowners to meet mortgage payments, potentially leading to foreclosure.

6. Renting vs. Buying in Early Adulthood (20s-30s)

Flexibility for career and lifestyle changes

Early adulthood is often a time of significant career and lifestyle changes. Renting provides the flexibility to adapt to these changes more easily, as individuals in their 20s and 30s may be exploring different job opportunities or considering further education. Renting allows for mobility and the ability to relocate for career advancement or other personal reasons.

Limited financial stability

In the early stages of adulthood, individuals may have limited financial stability. Renting allows them to have more manageable monthly expenses and lower upfront costs compared to homeownership. This flexibility can be advantageous for individuals who are still building their careers and may not yet have the financial stability required for homeownership.

Considerations for long-term plans

While renting may be suitable for early adulthood, it is essential to consider long-term plans. Individuals should evaluate their goals and determine if they foresee staying in one location for an extended period. If long-term stability is desired, it may be worth considering the potential benefits of homeownership, such as building equity and long-term investment opportunities.

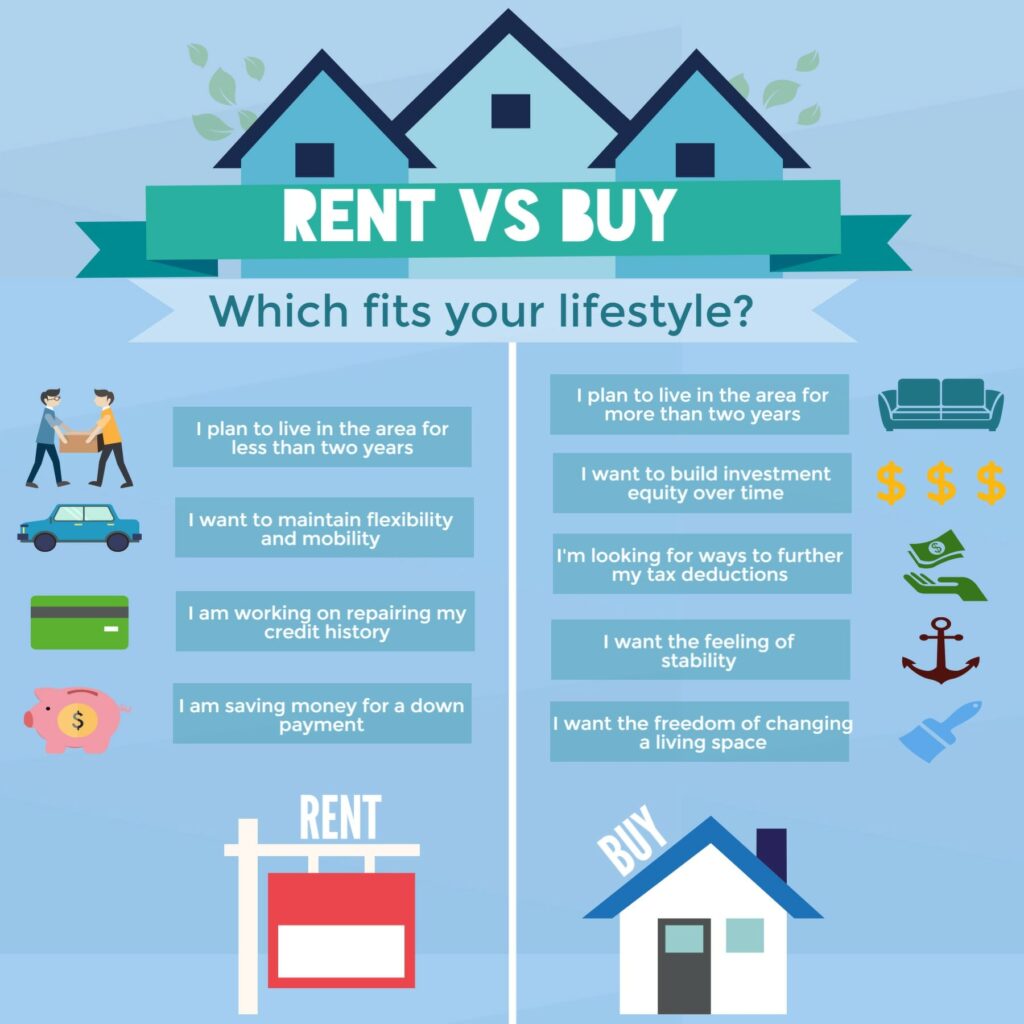

This image is property of firstcolonymortgage.com.

7. Renting vs. Buying in Mid-Life (30s-50s)

Financial stability and investment opportunities

Mid-life often brings increased financial stability, making homeownership a viable option. With more stable employment and a better understanding of long-term goals, purchasing a property can be seen as an investment opportunity. Homeownership allows individuals to build equity and potentially create a valuable asset for their retirement years.

Family and space requirements

As individuals enter their 30s and beyond, starting a family or needing more space becomes a priority. Owning a home provides the stability and control needed to cater to growing family needs. Homeowners can customize their living space to accommodate their family’s requirements without concerns about landlords’ restrictions.

Balancing current affordability with long-term goals

In the mid-life stage, individuals need to balance their current affordability with long-term goals. It is crucial to prioritize financial stability and avoid overextending financially. Careful consideration should be given to mortgage payments and other related costs to ensure they align with both short-term financial capabilities and long-term goals.

8. Renting vs. Buying in Retirement Years (50s and beyond)

Financial considerations and retirement savings

Retirement years require a focus on financial considerations and retirement savings. Renting can be a viable option for individuals who want to maintain financial flexibility during their retirement. Rent payments may be more predictable, allowing retirees to allocate their savings to other needs or investments, rather than being tied up in home equity.

Changing lifestyle and health needs

As individuals age, lifestyle and health needs may change. Renting provides the flexibility to adjust living arrangements to suit changing circumstances. For example, transitioning to a retirement community or downsizing to a smaller and more manageable space may be more attainable through renting.

Long-term housing options for senior citizens

Senior citizens may face specific housing challenges, such as accessibility and proximity to medical facilities. Renting can offer suitable long-term housing options that cater to these needs, providing a hassle-free living arrangement with minimal maintenance responsibilities.

This image is property of pigeon605.com.

9. Renting vs. Buying: Market Trends and Factors

Real estate market conditions and trends

Market conditions and trends play a significant role in the decision between renting and buying. Understanding the real estate market’s current state in the desired location is crucial in determining the viability of homeownership. Factors such as housing prices, inventory levels, and interest rates can influence the financial stability and affordability of buying a property.

Interest rates and mortgage options

Interest rates and mortgage options are important considerations when deciding between renting and buying. Low-interest rates can make homeownership more accessible and affordable, while higher interest rates may discourage potential buyers. Researching and comparing mortgage options is essential to find the best fit for individual financial situations.

Location-specific factors

Location-specific factors, such as the cost of living, rental market dynamics, and job opportunities, are essential aspects to consider. Renting or buying decisions greatly depend on the local housing market and the individual’s financial capabilities relative to the specific area. Factors like proximity to amenities and quality of life also influence the decision-making process.

10. Factors to Consider when Deciding

Financial situation and stability

Evaluating one’s financial situation and stability is crucial when deciding between renting and buying. Reviewing income, savings, debt, and credit score can help individuals determine their affordability and eligibility for a mortgage. It is essential to consider the long-term financial impact and ensure the chosen option aligns with financial goals.

Long-term plans and goals

Considering long-term plans and goals is vital when making the decision. Individuals should evaluate where they see themselves in the next five to ten years and determine if renting or buying supports those aspirations. Factors such as career goals, family planning, and lifestyle preferences can guide the decision.

Personal preferences and lifestyle

Personal preferences and lifestyle play a significant role in the decision-making process. Some individuals prioritize flexibility and the freedom to relocate, while others seek stability and the ability to customize their living space. Understanding personal preferences and lifestyle needs is crucial in determining which option aligns best.

Analysis of current real estate market

Analyzing the current real estate market is essential, considering factors such as housing prices, market trends, and interest rates. This analysis helps individuals gauge the financial feasibility and make an informed decision. Monitoring market indicators and seeking professional advice can provide valuable insights.

Professional advice and guidance

Seeking professional advice and guidance from real estate agents, financial advisors, or mortgage lenders is highly recommended. These professionals can provide personalized advice based on individual circumstances and goals. They can help navigate the complexities of the renting and buying process, ensuring that individuals make the most suitable decision for their situation.

In conclusion, the decision between renting and buying is a significant one that depends on various factors such as financial stability, personal preferences, and long-term goals. Renting offers flexibility and lower upfront costs, while buying provides the potential for equity building and customization. Specific life stages, such as early adulthood, mid-life, and retirement, bring unique considerations that should be taken into account. Additionally, the analysis of market trends and seeking professional guidance are essential in making an informed decision. Ultimately, individuals should carefully evaluate their circumstances and priorities to determine whether renting or buying is the right choice for them.